Premium Only Content

RefundPros

Refund Pros specializes in helping small businesses claim the Employee Retention Credit (ERC) a government-backed program designed to reward businesses that retained their employees during the COVID-19 pandemic. With deep expertise in IRS regulations and a streamlined, audit-ready process, Refund Pros helps eligible companies secure thousands even millions of dollars in refundable tax credits.

Whether you’re a business owner unsure of your eligibility or overwhelmed by complex tax forms, Refund Pros simplifies the ERC filing process to get you the maximum refund with minimal hassle.

✨ Why Choose Refund Pros?

Choosing Refund Pros gives business owners peace of mind knowing their ERC claim is in the hands of trusted tax professionals. Here's why so many companies rely on their team:

✅ Specialized Focus on ERC Only

Unlike general tax firms or payroll providers, Refund Pros focuses exclusively on the Employee Retention Credit. Their entire system, staff training, and client strategy revolve around maximizing your ERC refund while ensuring full compliance with IRS regulations. This level of specialization means your business receives unmatched attention and insight into every eligible quarter.

✅ IRS Audit Protection Built In

Filing for the ERC involves strict IRS criteria and complex documentation. Refund Pros gives every client comprehensive audit protection, so if the IRS ever comes knocking, you’re not alone. Their in-house experts are ready to back your claim with proper documentation, calculation transparency, and professional representation.

✅ Up to $26,000 Per Employee

The ERC allows eligible businesses to receive up to $26,000 per W-2 employee — and most business owners are unaware of the full amount they may be eligible for. Refund Pros maximizes your refund using precise payroll analysis, eligibility reviews, and legal tax strategies.

✅ No Upfront Fees – 100% Contingency Based

Refund Pros works on a success-only model. This means you don’t pay a dime unless your ERC claim is approved and you receive your refund. With no upfront costs and no risk, businesses can pursue what they’re owed with complete confidence.

✅ Fast, Simple, and Secure Application Process

Their ERC filing system is designed for speed and simplicity. Just upload basic payroll documents, and the team handles the rest — from eligibility verification to credit calculation and IRS submission. All documents are managed on a secure platform with strict data encryption.

✅ Support for All Industries

From construction companies and medical practices to restaurants, manufacturers, and non-profits, Refund Pros serves businesses across a wide range of industries. Whether you had reduced revenue or experienced COVID-related disruptions, their team evaluates your situation against IRS rules to determine maximum eligibility.

🧾 Services Offered by Refund Pros

Refund Pros delivers full-service ERC consulting with a hands-on, end-to-end approach. Here’s what their services include:

📄 Eligibility Analysis

Their team performs a detailed review of your financial records, payroll data, and COVID-related business impacts to determine if you qualify under one or more ERC pathways. This includes the gross receipts test and government order impact test.

📊 Credit Calculation

Using IRS guidelines, Refund Pros calculates your maximum refundable credit per employee across each eligible quarter. Their calculations ensure compliance with IRS Notice 2021-20, 2021-23, and subsequent updates.

📝 Documentation & Filing

Once the credit amount is determined, Refund Pros prepares and submits the required amended 941-X forms directly to the IRS on your behalf. They also generate a comprehensive, audit-ready file with all supporting documents.

🔐 IRS Audit Defense

If the IRS audits your ERC claim, Refund Pros provides full representation. Their audit protection includes documentation review, response handling, and communication with IRS agents to support and defend your refund.

💬 Ongoing Support

Even after filing, their team stays in touch to update you on refund status, expected IRS timelines, and additional updates related to ERC law. Clients can always reach out with questions or request status checks.

📈 Who Qualifies for the ERC?

Many businesses assume they don’t qualify for the ERC—but in reality, more than 70% of eligible businesses haven’t claimed their credit. You may be eligible if:

You had W-2 employees in 2020 and/or 2021.

You experienced a decline in gross receipts compared to 2019.

Your business operations were partially or fully suspended due to government mandates.

You’re a startup business that began after February 15, 2020 (for Recovery Startup Business credits).

You previously received PPP loans — yes, you can still qualify for ERC in many cases.

📞 Ready to See If You Qualify?

Take the first step today — visit RefundPros and start your free ERC evaluation. In just minutes, you’ll know whether your business qualifies and how much you could claim. Their team of experts will handle the rest, from paperwork to filing to refund.

Business Address: 1451B Ellis St, Kelowna, BC V1Y 2A3, Canada

Business Phone: +1 778-760-8444

Visit for more info: https://refundpros.com/

Hours of Operation: Monday-Thursday: 8:00 am–4:30 pm, Friday: 8:00 am–2:00 pm

-

LIVE

LIVE

Russell Brand

37 minutes agoMichigan Church Shooting Sparks Trump Warning Of ‘TARGETED ATTACK On Christians’ - SF641

18,946 watching -

LIVE

LIVE

The Charlie Kirk Show

1 hour agoRemembering Charlie's Martyrdom and Continuing His Revival | Driscoll, McPherson | 9.29.2025

15,242 watching -

46:58

46:58

MattMorseTV

2 hours ago $2.90 earned🔴COURT DATE for Kirk's ASSASSIN.🔴

10.1K16 -

LIVE

LIVE

Nerdrotic

1 hour agoOne Woke After Another | JK Rowling NUKES Emma Watson - Nerdrotic Nooner 520

842 watching -

LIVE

LIVE

Steven Crowder

3 hours ago🔴 Trump Hammers Portland: ANTIFA is a Terrorist Organization that Must be Crushed

27,799 watching -

LIVE

LIVE

Side Scrollers Podcast

2 hours agoSmash Pro DEMANDS “Woke Echo Chamber” + EA SOLD To Saudis + More | Side Scrollers

307 watching -

LIVE

LIVE

Viss

1 hour ago🔴LIVE - How To Win in PUBG - PUBG 101 with Viss

81 watching -

LIVE

LIVE

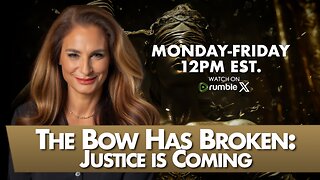

The Mel K Show

1 hour agoMORNINGS WITH MEL K - The Bow Has Broken: Justice is Coming 9-29-25

1,253 watching -

1:01:09

1:01:09

The Rubin Report

2 hours agoCNN Liberals Go Silent as Guest Points Out Fact After Fact on Left Wing Violence

25K39 -

2:04:17

2:04:17

Benny Johnson

3 hours agoChristianity Under Attack: Trump Declares 'Epidemic of Violence' on Christians As Church Shot,Burned

84.1K64