Premium Only Content

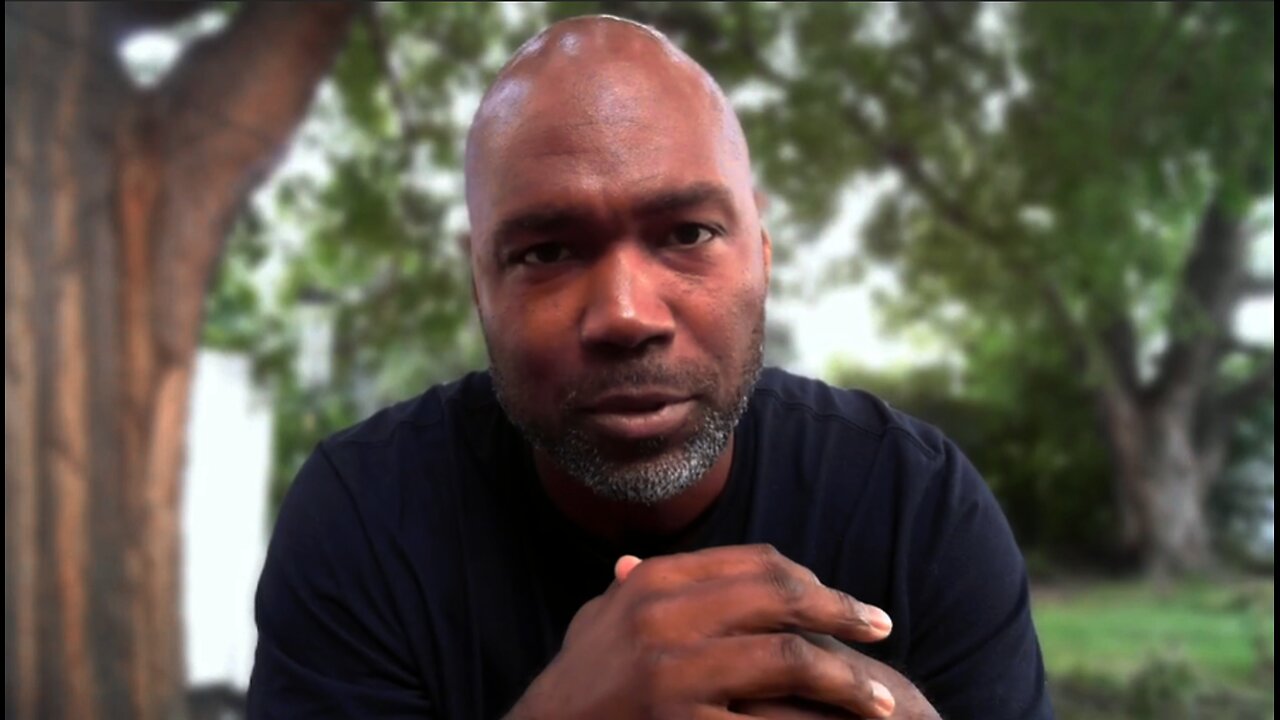

Government Buys 10% of Intel: What They’re Not Telling You

The US government just bought 10% of Intel stock, reshaping capitalism and raising questions about free markets. The government just bought 10% of Intel stock, making Washington one of the company’s biggest investors. This is not a bailout like in 2008. This is a deliberate move into semiconductors, AI, and national security industries.

In this video, I break down:

1. Why Trump’s administration is turning Washington into Wall Street

2. The rise of golden shares in US Steel and Intel

3. What state capitalism means for investors like you

4. How this could signal the end of free market capitalism in America

This is not just about Intel. It’s about a new era where the government is no longer a referee. It’s now a player in the market, with real skin in the game.

If this topic matters to you, hit LIKE, drop a COMMENT, and SHARE this video to help more people understand what’s really going on in America today.

Why are people stacking tiny 1/4 grain gold cards? It’s not just for collecting, smart preppers know why: ➡ https://minigoldbars.com

Could 1 gram of elite Swiss platinum be your smartest investment yet? Here’s why serious investors are jumping in: ➡ https://bit.ly/FinePlatinumBar

Can silver and automation really build wealth? This system might change how you think about both: ➡ https://mysilverteam.com

Think silver’s too expensive? Think again and grab the Freedom Round at a price that might shock you: ➡ https://bit.ly/Freedom_Round

Feel like something’s off with the system? These 5 steps to financial freedom might be exactly what you need: ➡ https://www.rethinkingthedollar.com

Don’t get left in the dark and get real news that matters delivered straight to you: 📡 https://www.rethinkingthedollar.com/social-media

If you believe in truth, follow RTD and stay informed when it matters most, and support the mission to help more people wake up: ❤️ https://www.rethinkingthedollar.com/donate/

DISCLAIMER: The financial and political opinions expressed in this video are those of the guest and not necessarily of "Rethinking the Dollar." Views expressed in this video should not be relied on for making investment decisions or tax advice and do not constitute personalized investment advice. The information shared is for the sole purpose of education and entertainment only.

-

30:49

30:49

Rethinking the Dollar

1 day agoMarkets Panic: Government Shutdown Sends Gold & Bitcoin Higher | Morning Check-In: Let's Talk...

23.1K3 -

1:01:36

1:01:36

Dear America

1 hour agoEpisode 2 Graham Allen Show

6.93K20 -

1:59:01

1:59:01

The Charlie Kirk Show

2 hours agoCancel Netflix? + The Secret Service Disaster + Turning Point Everywhere | Tatum, Cocca, Gaffrey

90.8K31 -

LIVE

LIVE

ahdedazs

1 hour agoBlack Ops 7 EARLY ACCESS BETA! First Stream on RUMBLE!

89 watching -

LIVE

LIVE

ZENNY

1 hour agoBO7 IS HERE BOT POV MF HAHAHAHA 6v6 PG18+ | UNFILTERED CHAT | CURSES AND BAD

82 watching -

LIVE

LIVE

qixso

2 hours ago $0.26 earnedBO7 IS HERE TAP IN !! | @qixso

123 watching -

1:37:49

1:37:49

Tucker Carlson

15 hours agoBlackmail, Bribes, and Fear: Netanyahu Claims He Controls Donald Trump and America. Tucker Responds.

58.3K237 -

1:37:29

1:37:29

The Mel K Show

3 hours agoMORNINGS WITH MEL K - Information Warfare & Common Sense 10-2-25

8.16K5 -

1:26:12

1:26:12

Steven Crowder

5 hours agoThe Left is Violent (Part 2) | Change My Mind

313K436 -

40:54

40:54

The Rubin Report

3 hours ago‘The View’ Hosts Aghast When Mamdani Accidentally Repeats Hamas Talking Points

54.3K65