Premium Only Content

Analyst Who Predicted 2008 Crash Sounds Alarm "Gold & Silver To Be Rocket-Propelled" - Mike Maloney

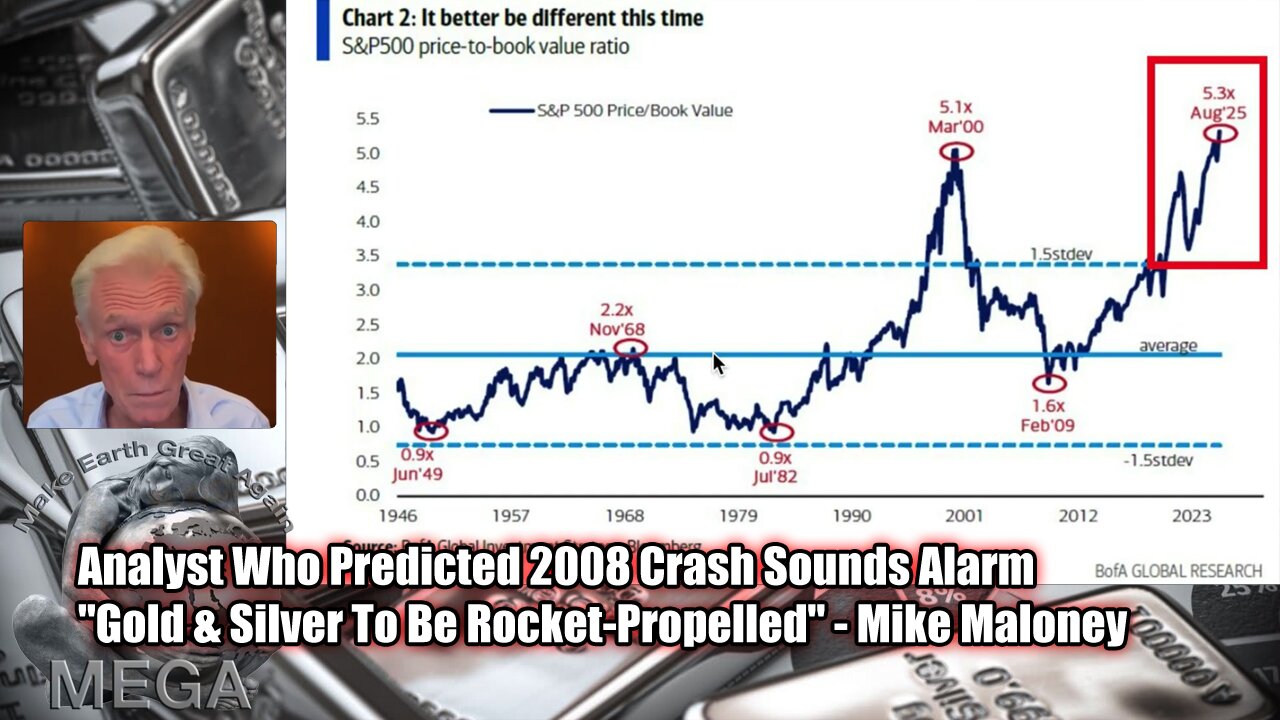

In this hard-hitting update, Mike Maloney lays out why he believes today’s setup outstrips 1929 and the dot-com era—and why stocks and real estate could correct together.

.

Inside you’ll see:

• The valuation dashboard (Buffett Indicator, Tobin’s Q, CAPE, P/B) and why “long-term averages” may be misleading when you add an extra century of data.

• How index concentration, mega-cap cash-flow multiples, and extreme P/Es mirror late-stage bubbles.

• Classic warning lights: Dow Transports diverging, insiders dumping, and a yield-curve signal with a track record before major selloffs.

• Why housing weakness raises the stakes—and why Mike thinks gold & silver remain the outliers.

.

If you want a data-driven tour of today’s “almost everything” bubble—and practical takeaways for protecting your wealth—watch to the end.

.

Chapters

00:00 Bubble scoreboard across history

03:00 Buffett Indicator & “bubble century”

08:00 CAPE, Tobin’s Q, P/B—what’s elevated now

11:30 Dow Theory: Transports vs. the indices

13:40 Insider selling & yield-curve trigger

21:30 Stocks + housing: a dual risk

30:10 Why gold & silver may be next

-

LIVE

LIVE

Alex Zedra

1 hour agoLIVE! Bo7 Warzone

719 watching -

LIVE

LIVE

Drew Hernandez

20 hours agoCANDACE OWENS / TPUSA STALEMATE & DC PIPE BOMBER CAPTURED?!

826 watching -

12:31

12:31

Robbi On The Record

3 hours ago $0.23 earnedWhy Nothing Feels Real Anymore | The Science, Culture, and Spiritual War Behind the Fog

7.67K7 -

18:42

18:42

Navy Media

4 hours agoHouthis ATTACK the Wrong U.S. Fighter Jet – Then THIS Happened…

11.1K19 -

40:24

40:24

MetatronGaming

1 day agoSomething is REALLY Wrong with this apartment...

5.75K2 -

LIVE

LIVE

SpartakusLIVE

3 hours agoHUGE NEW UPDATE - Aim Assist NERF, New META, New MOVEMENT || #1 King of Content

220 watching -

![battlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]](https://1a-1791.com/video/fwe2/7f/s8/6/w/D/y/F/wDyFz.0kob.15.jpg) LIVE

LIVE

XDDX_HiTower

2 hours agobattlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]

135 watching -

2:28:57

2:28:57

Nikko Ortiz

3 hours agoVirtual Reality Milsim... | Rumble LIVE

20.5K4 -

LIVE

LIVE

StevieTLIVE

2 hours agoNEW UPDATE Warzone WINS w/ The Fellas

60 watching -

9:00:32

9:00:32

Dr Disrespect

12 hours ago🔴LIVE - DR DISRESPECT - WARZONE x BLACK OPS 7 - SEASON 1 INTEGRATION

143K7