Premium Only Content

The Impact of Liquidity on Cryptocurrency

Liquidity is the invisible force that decides who wins and who loses in crypto 💧

Most people chase coins, prices, and hype. But the real game is hidden in the liquidity pool. In 2021, over 70% of rug pulls happened in projects with less than 100k liquidity . That means the risk wasn’t the idea or the chart — it was the lack of exit doors.

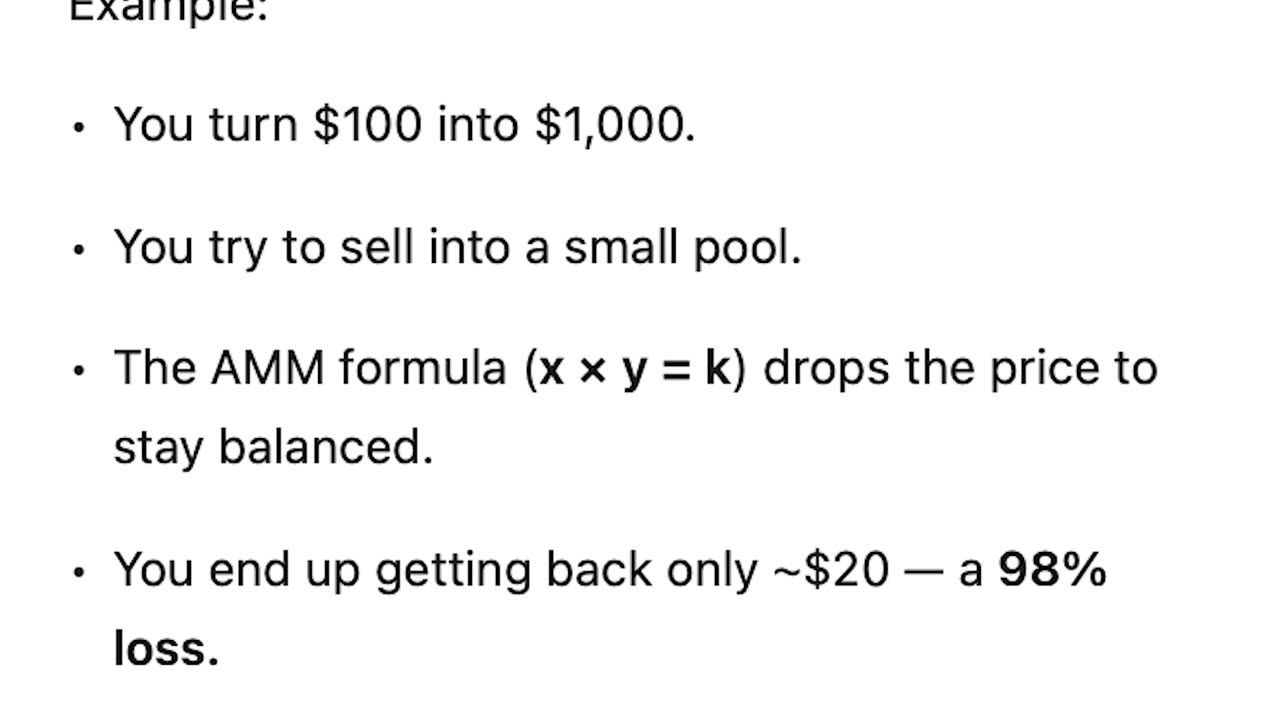

Liquidity doesn’t just protect you from scams. It shapes price impact — the difference between paper profits and real profits. If you can’t exit clean, you didn’t actually make money. A strong pool keeps trades stable, while a weak one can destroy your gains in seconds.

Here’s the part most traders miss: liquidity is like the credibility bank of crypto. It’s what separates a token that can survive millions in volume from one that collapses under a single big trade. Find the balance where liquidity is deep enough for trust but light enough for growth — and you’ll see why seasoned traders obsess over it.

Price lies. Liquidity doesn’t.

-

2:57:51

2:57:51

TimcastIRL

4 hours agoShots Fired At Timcast Studio, Man Arrested For Stalking Benny, Loomer, Matt Walsh | Timcast IRL

234K217 -

3:03:45

3:03:45

Decoy

3 hours agoIt's happening

21.7K4 -

26:14

26:14

Jasmin Laine

8 hours agoBREAKING: Liberals Caught Cutting SECRET Deal to Rewrite Speech Laws

11.9K24 -

17:33

17:33

Navy Media

6 hours ago $1.23 earnedChinese Fighter Jet Flies TOO CLOSE to US Navy Destroyer – BIG MISTAKE

12.7K2 -

51:11

51:11

Jamie Kennedy

3 hours agoAre We All Being Played? Comedy, Politics, Sports & The Illusion of Control | Ep 234 HTBITY

11.6K -

LIVE

LIVE

SpartakusLIVE

5 hours ago#1 Challenge MASTER brings YOU Monday Motivation

538 watching -

LIVE

LIVE

Drew Hernandez

21 hours agoTIMCAST IRL STUDIO COMPOUND SHOT AT & TRUMP COMPLAINS ABOUT RINOS STALLING HIM

830 watching -

LIVE

LIVE

svgames

5 hours ago🟢LIVE - ARC RAIDERS WITH @ZWOGS - BIRTHDAY / ONE YEAR ON RUMBLE

198 watching -

1:36:51

1:36:51

Glenn Greenwald

6 hours agoTrump's New National Security Doctrine; What Marjorie Taylor Greene's Split with MAGA Reveals About the White House's Political Problems | SYSTEM UPDATE #555

111K39 -

LIVE

LIVE

GritsGG

10 hours agoBO7 Warzone Is Here! Win Streaking! New Leaderboard?

57 watching