Premium Only Content

Is Jio Financial the Next Big Thing? Stock & Business Deep Dive

Jio Financial Services (JFS) is a significant player in the Indian financial services sector, having been demerged from Reliance Industries. As a digital-first organization, it offers a range of financial products and aims to democratize financial services in India.

Here's an overview of its stock market performance and details:

Stock Performance and Valuation

Market Capitalization: Jio Financial Services is a large-cap company with a market capitalization of over ₹2,00,000 crore.

Price-to-Earnings (P/E) Ratio: The stock's P/E ratio is notably high compared to the industry average, suggesting that it may be overvalued based on current earnings. This often happens with growth-oriented companies where investors are anticipating future growth.

Price-to-Book (P/B) Ratio: The P/B ratio is above the industry median, also indicating a potentially high valuation.

Share Price: The stock has shown volatility since its listing, with a 52-week high of around ₹363 and a low of around ₹198.65.

Recent Performance: The stock has shown some positive momentum recently, with consecutive gains over a period of six days and trading above its 100-day and 200-day moving averages. However, its one-year performance has been negative.

Business and Financials

Core Business: JFS operates in various segments, including:

Lending: Offering a suite of lending products like home loans, loans against property, and supply chain finance.

Investment: A joint venture with BlackRock to offer investment solutions and an asset management company.

Transactions and Payments: Services like payment gateways, payment banks, and the JioFinance app.

Insurance: Providing access to life, motor, health, and general insurance.

Financial Results: The company has reported increasing total income and net profit in recent quarters, demonstrating strong execution and business growth. However, some financial metrics show high operating expenses and a decline in cash flow from operations in certain periods.

Debt: The company is considered to be almost debt-free.

Shareholding and Outlook

Shareholding Pattern: A significant portion of the company's shares is held by promoters, followed by foreign and domestic institutional investors, and then the public. FII and DII holdings have been increasing.

Strategic Initiatives: The company is focusing on enhancing its digital platforms and using advanced analytics to improve customer engagement and gain a competitive edge. It has also received regulatory approvals for its various business ventures, including a Core Investment Company license from the RBI and an online payment aggregator license.

Disclaimer: This information is for general informational purposes only and does not constitute financial advice. Stock market performance is subject to market risks, and it is recommended to conduct your own research or consult with a qualified financial advisor before making any investment decisions.

Jio Financial Services (JFS) — market cap, valuation, and whether it’s the next big thing in Indian finance. In this concise 2-minute deep dive we break down JFS stock performance (52-week high/low, P/E & P/B ratios, moving averages), core businesses — lending, payments, investments (JV with BlackRock), insurance — and strategic moves like digital-first platforms and regulatory approvals. We also cover recent financials, debt-free balance sheet, shareholding trends, and near-term risks. Data-driven insights to help you think critically about Jio Financial’s growth story and valuation. If this helped, please like and share the video. Disclaimer: Informational only — not financial advice. #JioFinancial #JFS #Investing #IndianStockMarket

-

DVR

DVR

Mally_Mouse

3 days ago🎮 Throwback Thursday! Let's Play: Stardew Valley pt. 32

16.3K1 -

28:25

28:25

ThisIsDeLaCruz

11 hours agoInside the Sphere Part 2: Kenny Chesney’s Vegas Stage Revealed

1.75K -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

138 watching -

LIVE

LIVE

SilverFox

21 hours ago🔴LIVE - ARC Raiders HUGE UPDATE - NEW MAP w/ Fragniac

110 watching -

2:11:25

2:11:25

Nikko Ortiz

3 hours agoLATE NIGHT GAMING... | Rumble LIVE

82.8K6 -

9:30:12

9:30:12

Dr Disrespect

11 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - NORTH LINE UPDATE

124K8 -

3:02:44

3:02:44

PNW_Guerrilla

3 hours agoHalo CE

5.1K -

1:01:11

1:01:11

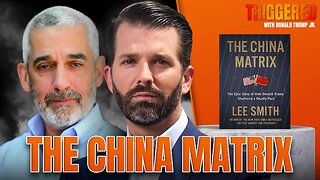

Donald Trump Jr.

9 hours agoThe China Matrix with Journalist Lee Smith | TRIGGERED Ep.291

91.6K79 -

LIVE

LIVE

XDDX_HiTower

2 hours ago $0.19 earnedARC RAIDERS, FIRST DROP IN

26 watching -

59:22

59:22

BonginoReport

5 hours agoWH Trolls Dems After Government Reopens - Nightly Scroll w/ Hayley Caronia (Ep.177)

64.7K52