Premium Only Content

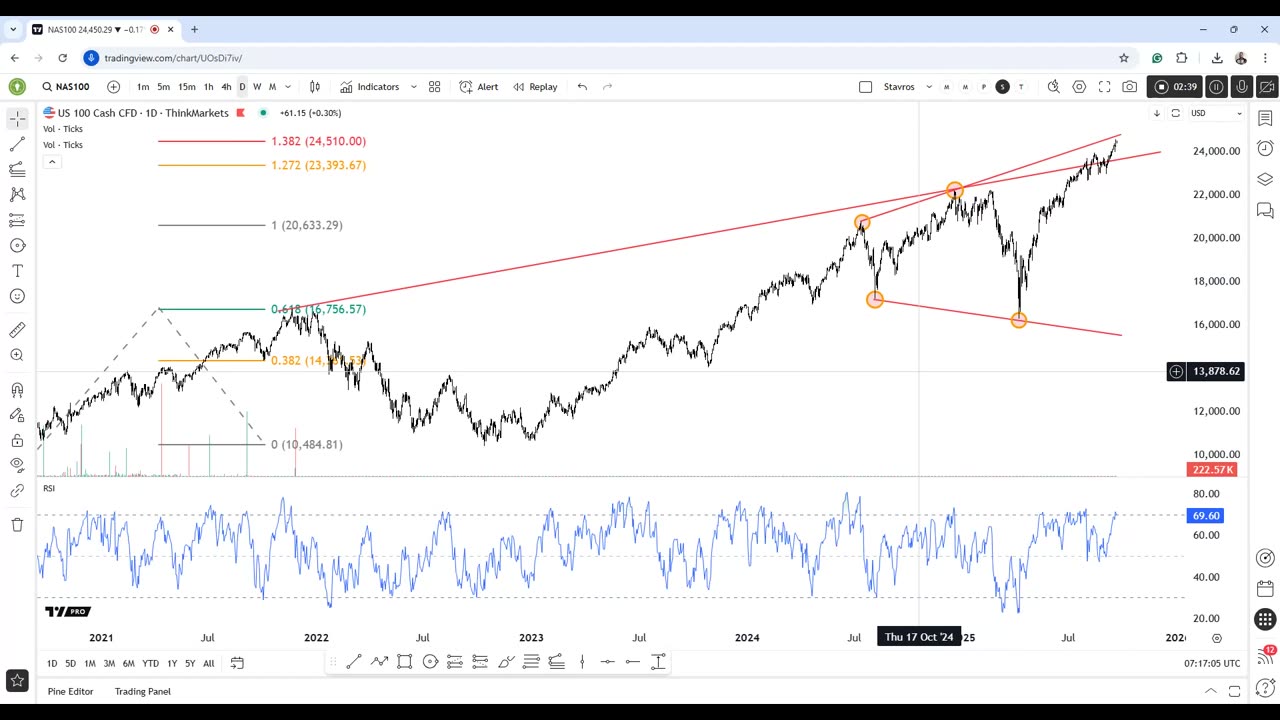

Nasdaq records near critical resistance! More to go or crash?

1

Grab this chart

154

Strong economic data suggest the soft landing scenario remains intact. Manufacturing strength, combined with improving employment data, appears to provide support. The Fed's dovish pivot also offers liquidity tailwinds, while the Nvidia-Intel partnership signals continued investment in US stocks.

But is the market reading the signals?

Strong employment data could actually be bearish for equities since it reduces the urgency for the Fed to cut. The Fed's dot plot already shows fewer 2026 cuts (only one instead of three) with higher growth and (slightly higher) inflation projections. The Nvidia-Intel deal also excludes Intel's struggling foundry business, a core problem for the company.

Technicals are not too promising either. Multiple resistance factors converge just a tad higher if not at current levels:

Long-term trendline from November 2021

138% Fibonacci level

Triangle pattern measured move completion

100% Fibonacci expansion target

Indicators flash warnings too:

RSI second divergence since May (price up, momentum flat)

Volume oscillator 13% below zero - lack of institutional buying

Missing third-wave volume surge - typical bull pattern absent

Fifth-wave characteristics suggesting impulse completion

As we trade in the historically worst month for equities, where the NASDAQ typically underperforms the S&P 500 during September selloffs, a high-probability short setup could be underway:

Entry: 24,700-24,750 area (resistance test)

Stop: Above 25,000 (avoid false breakout)

Targets: 23,700 → 22,730 → 22,200

Risk-Reward: Approximately 2.6:1 to first major support

Prefer a 5-wave decline if bear case confirms, followed by a 3-wave up, then continuation lower.

Watch 24,500 as it appears to be a decision point where multiple technical and fundamental factors converge.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

-

LIVE

LIVE

Jeff Ahern

1 hour agoThe Sunday show with Jeff Ahern

385 watching -

1:14:12

1:14:12

Sports Wars

4 hours agoMark Sanchez STABBED And Arrested, Bill Belichick DISASTER, MLB Playoffs, NFL Week 5

28.2K2 -

LIVE

LIVE

ttvglamourx

4 hours ago $8.95 earnedSUSSY SUNDAY !DISCORD

252 watching -

1:30:58

1:30:58

Lara Logan

2 days agoENEMY AT THE GATES: Trevor Loudon Unmasks the Sinister Alliance Working to Destroy America | Ep 38

33.9K55 -

4:12:00

4:12:00

TheItalianCEO

4 hours agoBest VIDEO GAMES on a Sunday

26.2K1 -

17:14

17:14

Mrgunsngear

22 hours ago $11.01 earnedDerya DY9 Review - The Best Budget Glock Clone?

40.1K12 -

8:46

8:46

It’s the Final Round

1 day ago $1.70 earned💰NFL Week 5 Best Bets🔥Player Prop Picks, Parlays, Predictions FREE Today October 5th

31.1K -

4:03:15

4:03:15

Amish Zaku

5 hours agoMaking Music & Thumbnails Then War Thunder - Hanging out with Chat

26K2 -

LIVE

LIVE

Barneyjack

5 hours agoWarframe LR5/MR35 Gaming, Mayhem & Fashion!! Get in here :) :)

73 watching -

30:00

30:00

BEK TV

4 days agoGUT HEALTH AND THE POWER OF KIMCHI WITH KIM BRIGHT ON TRENT ON THE LOOS

90.2K7