Premium Only Content

Deep Dive Update for Monday September 29, 2025

Link to The SPX Investing Program https://spxinvesting.substack.com

Link to The Daily Pivot Newsletter: https://thedailypivotnewsletter.substack.com/

Link to Video-Only Immediate Access:

https://spxvideos.substack.com/

The "Deep Dive Video Update" for Monday, September 29th, summarizes various market charts not regularly featured in daily videos, focusing on deeper insights into market sentiment and trends.

Key points include:

VIX Analysis: The Long-Term VIX (volatility index) remains below 20, indicating a positive market sentiment with low volatility. A 50-period exponential moving average shows the VIX in a lower range, and momentum indicators including the MACD and VIX/VVIX ratio suggest no strong directional movement, with the S&P rising as volatility declines.

Sentiment Gauges: The Ulcer Index is slightly up but below its moving average, indicating low market stress. The VIX-to-Move Index ratio (stocks vs. bond volatility) is rising, hinting at potential concern as stock volatility increases. The S&P-to-VIX correlation and volatility risk premium suggest some market fear, though not reflected in the VIX itself. The Skew Index, another sentiment gauge, is not signaling significant fear.

Market Ratios: The large cap-to-small cap ratio is stagnant, reflecting paused small-cap outperformance amid uncertainty about Federal Reserve rate cuts. Strong economic data (e.g., revised GDP, low jobless claims) suggests the Fed may not cut rates soon, impacting small and mid-cap stocks that benefit from lower rates.

Advance-Decline Lines: S&P 500 and NYSE advance-decline lines show flat or slightly positive trends, with volume-based indicators stronger than price, suggesting underlying market health but no strong conviction.

Sector and Index Trends: Large-cap growth ETFs and QQQs are positive, above moving averages, but showing pullbacks. Risk-on/risk-off and high-beta/low-beta ratios are declining despite a positive S&P on Friday, indicating possible defensiveness. Emerging markets outperforming U.S. and European markets, while U.S. stocks holding steady against international peers.

Technical Indicators: Short- and intermediate-term trends remain positive, with prices above key moving averages (20, 50, 100 periods). Long-term trends are also positive, with the S&P above anchored moving averages. Oscillators such as the Boom Indicator and Connors RSI show no extreme readings, and the market has not retraced enough for significant correction signals (e.g., 10%+ decline).

Sector-Specific Insights: Retail is in an uptrend but underperforming the S&P slightly. Discretionary-to-staples and tech-to-utilities ratios are leveling off, while biotech-to-healthcare looks strong. Home builders are declining due to rising 10-year yields, and regional banks and transports are sideways.

Bonds and Yields: Bond ratios (cash to 3-7 year, TIPS to bonds) are flat or downtrending, indicating no immediate inflation concerns. The 2-year Treasury yield is declining but not breaking key support. Gold and silver are outperforming the S&P.

Technical Scores: NASDAQ leads at 90.7, followed by QQQs (88.2), small caps (79.5), S&P (76.5), Dow (below pivot resistance), and mid-caps (47, weakest).

Overall Outlook: The market shows positive trends but with signs of caution (e.g., rising stock-bond volatility, declining risk-on ratios). A potential 3-10% pullback is considered normal without signaling a broader negative shift.

PDF of Slides:

https://drive.google.com/file/d/1iR4hOqMKv80sA8v04-WPeJhc_vyVAPN3/view?usp=sharing

DISCLAIMER This video is for entertainment purposes only. I am not a financial adviser, and you should do your own research and go through your own thought process before investing in a position. Trading is risky!

-

5:56

5:56

The SPX Investing Program

3 hours agoDaily Update Podcast for Friday October 17, 2025

9 -

9:21

9:21

Dr Disrespect

18 hours agoMOST INSANE 110 ASSIST Game in Battlefield 6

71.2K7 -

2:56:34

2:56:34

Side Scrollers Podcast

18 hours agoTwitch PROMOTES DIAPER FURRY + Asmongold/Trans CONTROVERSY + RIP Itagaki + More | Side Scrollers

41.9K6 -

23:30

23:30

GritsGG

14 hours agoThis Burst AR Still SLAMS! BR Casual Solos!

12K1 -

1:27:43

1:27:43

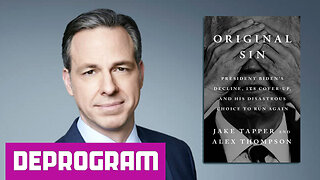

DeProgramShow

3 months agoEXCLUSIVE on DeProgram: “A Live Interview with Jake Tapper”

3.81K2 -

1:25:15

1:25:15

The HotSeat

14 hours agoHere's to an Eventful Weekend.....Frog Costumes and Retards.

14K8 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

130 watching -

1:34:23

1:34:23

FreshandFit

12 hours agoThe Simp Economy is Here To Stay

147K10 -

19:35

19:35

Real Estate

14 days ago $1.85 earnedMargin Debt HITS DANGEROUS NEW LEVEL: Your House WILL BE TAKEN

11.4K3 -

4:03:48

4:03:48

Alex Zedra

8 hours agoLIVE! Battlefield 6

48.4K2