Premium Only Content

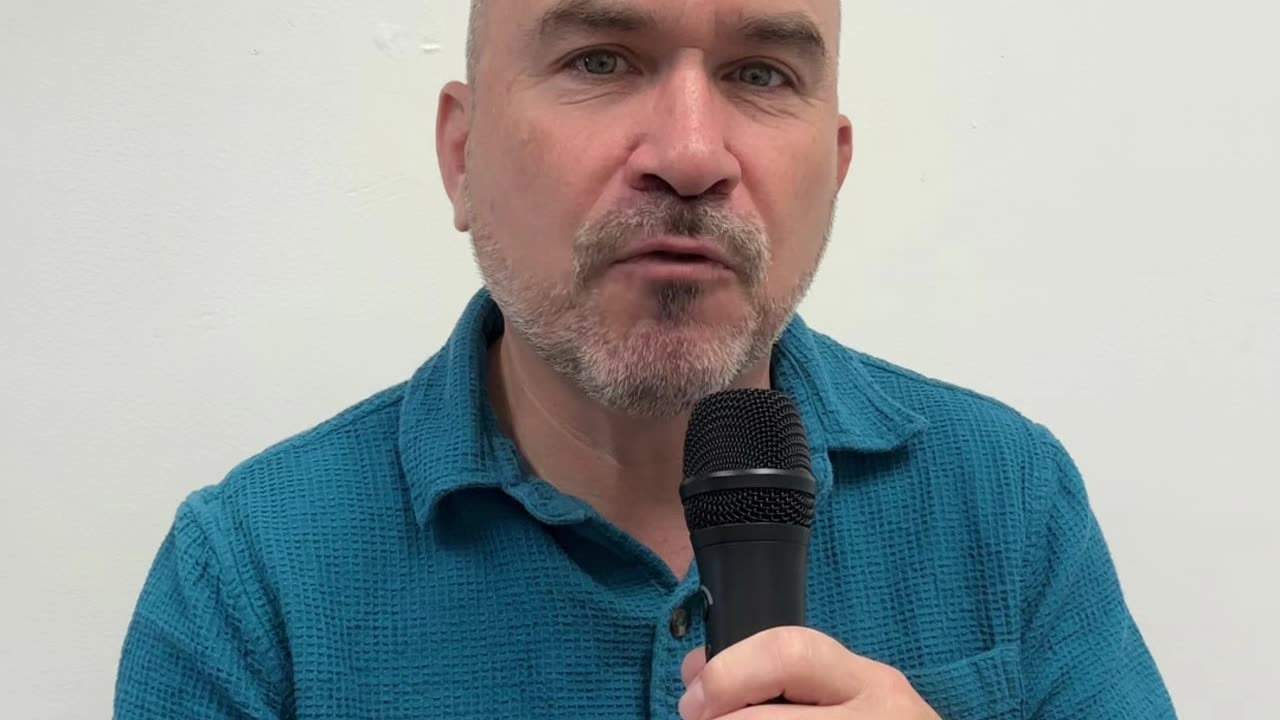

The Wealthy's Best Kept Secret: How to Sell Investment Property Without Paying Capital Gains

Investors and property owners, I'm about to share something that could save you hundreds of thousands of dollars - a completely legal strategy that most real estate agents either don't know about or aren't discussing with their clients.

It's called a 1031 Exchange, and it's one of the most powerful wealth-building tools available to property investors.

Here's the concept: You can sell your investment property and reinvest those proceeds into another like-kind property without paying any capital gains taxes - as long as you follow the specific rules and timelines.

The process works like this: When you sell your investment property, instead of taking the cash and paying capital gains taxes, you identify a replacement property within 45 days and complete the purchase within 180 days. The key is that all proceeds must go through a qualified intermediary - you never touch the money directly.

Miss either deadline? You'll pay the full capital gains tax. But execute it properly, and you can continue building your real estate portfolio on a tax-deferred basis, potentially for decades.

I've personally helped clients save hundreds of thousands of dollars using this strategy. In one case, a client avoided $180,000 in capital gains taxes by properly executing a 1031 exchange on a commercial property.

With today's market conditions creating both challenges and opportunities, you literally cannot afford to leave this kind of money on the table.

The 1031 exchange isn't just about avoiding taxes - it's about maximizing your investment potential. Instead of losing 20-30% of your gains to taxes, you can reinvest 100% of your proceeds into a larger, potentially more profitable property.

This strategy works for various property types: residential rentals, commercial buildings, raw land, and even some personal property used in business.

Want to know if your specific property qualifies for a 1031 exchange? Let's have that conversation.

I'm Steve Hise with eXp Realty, and I believe in helping investors build wealth strategically, not just making sales.

#stevehise #simivalley #simivalleyrealestate #1031exchange #realestate #taxstrategy #investors

-

2:55

2:55

GreenMan Studio

14 hours agoWHAT IS FREEDOM? w/ GreenMan Reports

4.09K -

LIVE

LIVE

The Bubba Army

22 hours agoDONALD TRUMP SAYS "Black People Love Trump!" - Bubba the Love Sponge® Show | 12/10/25

1,310 watching -

29:54

29:54

ZeeeMedia

14 hours agoAus Social Media Ban & British Govt's 'Emotion Detection' Cameras | Daily Pulse Ep 159

10.4K20 -

LIVE

LIVE

GritsGG

17 hours agoBO7 Warzone Is Here! Win Streaking! New Leaderboard?

439 watching -

1:00:41

1:00:41

Coin Stories with Natalie Brunell

18 hours agoBitcoin, Chasing Freedom & Breaking the Victimhood Cycle with Efrat Fenigson

68.7K2 -

10:38

10:38

MattMorseTV

16 hours ago $23.30 earnedEU plans $2.34 Trillion ATTACK on U.S.A.

93.6K97 -

35:41

35:41

MetatronGaming

2 days agoLet's Play HEXEN!

22.8K4 -

2:08:37

2:08:37

Side Scrollers Podcast

21 hours agoNetflix/WB Will RUIN Entertainment + Anita Sarkessian “doesn’t deserve hate” + More | Side Scrollers

65.8K7 -

2:00:01

2:00:01

TruthStream with Joe and Scott

18 hours agoAdrenochrome, Time Travel and Wormholes! Our most mindbending and mindblowing interview to date!! Premiers 12/9 3pm pacific 6pm eastern

21.9K11 -

1:41:23

1:41:23

The Michelle Moore Show

20 hours ago'Setting the Record Straight On Many Myths and Lies We've Been Told Concerning Our Health' Guest, Dr. Margaret Aranda: The Michelle Moore Show (Dec 9, 2025)

25.8K6