Premium Only Content

Fintech Cybersecurity & Compliance Simplified – Copla Platform

Website Link Below:

https://join.copla.com/bfmcpa7duprl

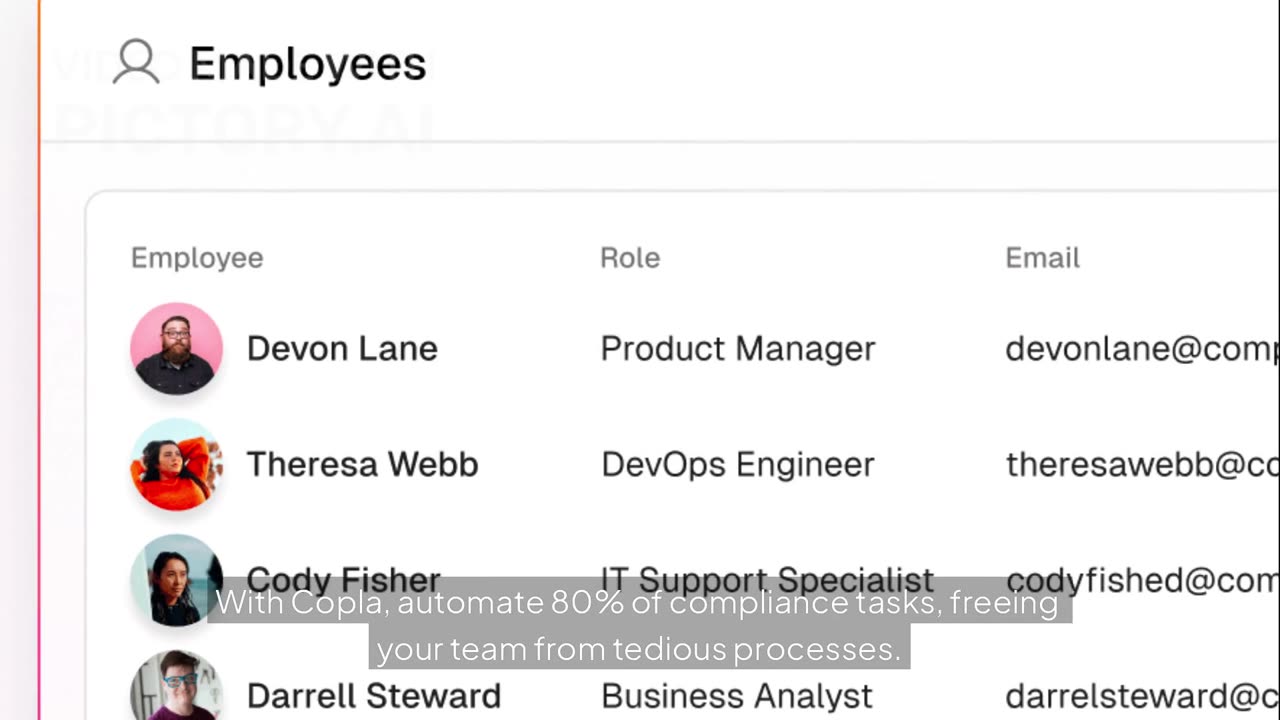

Copla provides advanced cybersecurity and compliance automation specifically for fintech companies, leveraging deep regulatory expertise and experience in financial technology. Our AI-powered platform helps CTOs and security teams understand the real state of ICT security, propose actionable improvements, guide execution, and maintain continuous audit readiness.

Key benefits for fintech organizations:

80% Workload Reduction: Automate repetitive compliance tasks to free your team for strategic work.

Continuous Audit-Readiness: Centralized evidence collection, documentation, and compliance-focused reporting for ISO 27001, NIS2, PSD2, and DORA.

Real-Time Risk Monitoring: Track operational and cybersecurity risks with actionable insights and a centralized risk register.

Automated Vendor Risk Management: Streamline due diligence, risk tracking, and security questionnaires with AI.

Personalized Security Training: Engage employees through automated, role-specific training workflows tailored to risk levels and performance.

Disaster Recovery Planning & Simulations: Identify and fix operational gaps before they become problems, ensuring business continuity.

Expert Fintech CISO Support: Personalized guidance to address every security gap and navigate regulatory frameworks effectively.

Copla enables fintechs to build trust, maintain resilience, and scale securely while reducing manual compliance overhead. Whether managing vendor risks, regulatory reporting, or team training, Copla automates processes for measurable efficiency and compliance assurance.

#FintechSecurity #Copla #AutomatedCompliance #ISO27001 #PSD2 #NIS2 #DORACompliance #RiskManagement #VendorRiskManagement #CybersecurityAutomation #AuditReady #CISO #ContinuousMonitoring #FintechCompliance #DisasterRecovery #BusinessContinuity #FinancialTechnologySecurity #SecurityWorkflows #EnterpriseFintech

-

5:13

5:13

Buddy Brown

7 hours ago $0.78 earnedMuslim PATROL CARS Begin Monitoring NYC! | Buddy Brown

2.63K9 -

12:54

12:54

MetatronGaming

3 hours agoYou Remember Super Mario WRONG and I can Prove it

10.7K4 -

1:02:55

1:02:55

Russell Brand

3 hours agoThe Epstein Files Are Coming — And The Establishment Is Terrified! - SF653

81.7K14 -

32:47

32:47

The White House

3 hours agoPresident Trump Meets with Zohran Mamdani, Mayor-Elect, New York City

22.4K54 -

1:07:21

1:07:21

The Quartering

2 hours agoPeace Between Ukraine & Russia? Kimmel Meltdown & More layoffs

27.8K13 -

LIVE

LIVE

Barry Cunningham

3 hours agoBREAKING NEWS: PRESIDENT TRUMP MEETS WITH COMMIE MAMDANI | AND MORE NEWS!

1,165 watching -

LIVE

LIVE

LadyDesireeMusic

2 hours ago $1.14 earnedLive Piano Music & Convo | Anti Brain Rot | Make Ladies Great Again | White Pill of the Day

90 watching -

LIVE

LIVE

StoneMountain64

4 hours agoArc Raiders Making Money and LEVELING Up

104 watching -

LIVE

LIVE

ReAnimateHer

6 hours ago $0.58 earnedNell’s Diner Is OPEN… For Your Final Meal

29 watching -

14:53

14:53

Neil McCoy-Ward

10 hours ago🇦🇺 Australian Censorship Chief SUMMONED For Questioning In USA!!! 🇺🇸

6.73K9