Premium Only Content

He Saw the 2008 Crash Coming… Now He’s Warning About the AI Bubble

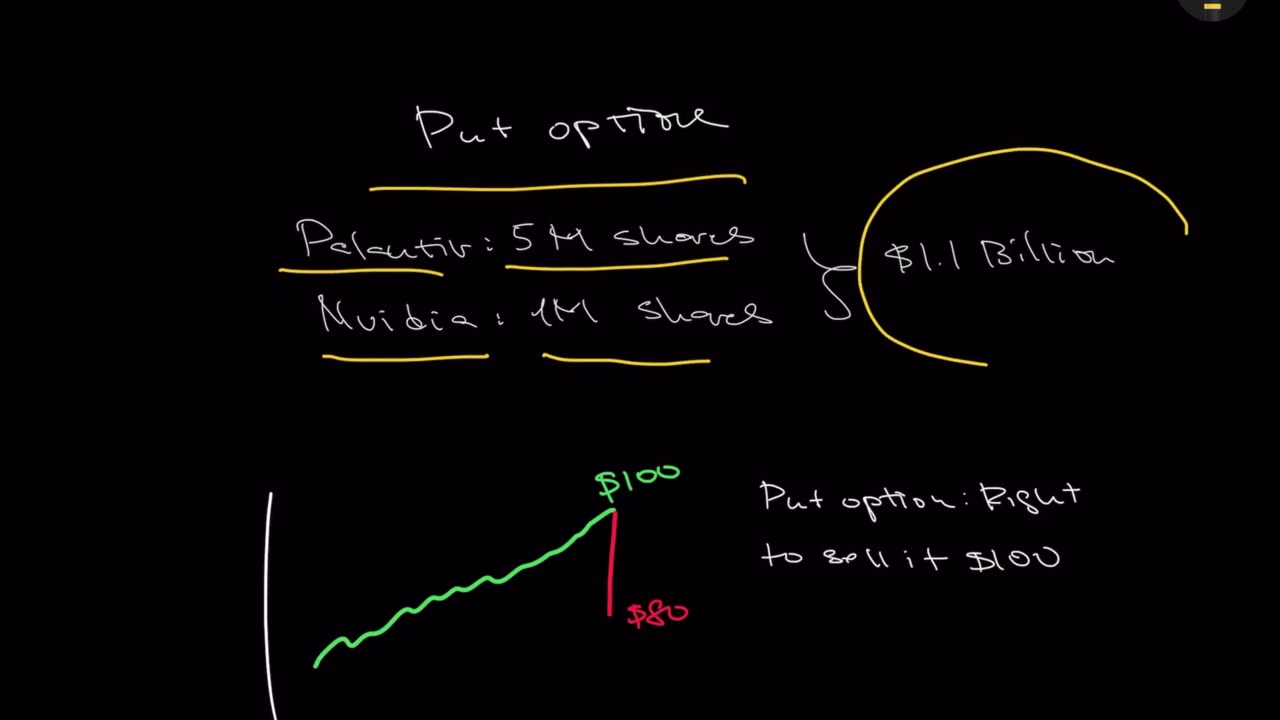

The investor who famously predicted the 2008 financial collapse is now warning that the AI boom is dangerously overhyped — and he’s backing that belief with billions of dollars. While the world celebrates artificial intelligence as the future of innovation, automation, and profit, one of the sharpest financial minds in modern history is taking the opposite position.

This video explains why the man who saw the last major crisis coming is now betting against the AI sector.

We examine:

Why AI companies are being valued at levels that don’t match real earnings

The extreme cost of running, training, and scaling AI systems

How corporations are claiming “AI integration” without measurable results

Why investors may be chasing a narrative instead of real economic fundamentals

The parallels between the AI boom and previous speculative market bubbles

The warning signs that insiders have already begun to notice

This is not about denying the power or potential of artificial intelligence. It’s about recognizing the difference between technology adoption and market speculation — and understanding what happens when expectations rise faster than reality.

The last time this man sounded the alarm, most people ignored him — and the result was one of the worst economic crises in modern history. Today, he’s sounding the alarm again.

👍 Like

💬 Comment your thoughts

🔔 Follow for more market and economic analysis

-

Stephen Gardner

1 hour agoBREAKING LEAK: Trump Prepping Huge White House Shake-Up!

2.34K5 -

1:29:42

1:29:42

The Quartering

2 hours agoTrumps Turkey Pardon Roast, Woke Pastor Destroyed, AI To Replace 40% Of Workers & More

86.4K11 -

1:08:32

1:08:32

DeVory Darkins

3 hours agoBREAKING: Minnesota Judge Makes FATAL MISTAKE Overturning Jury’s $7.2M Somali Fraud Verdict

104K75 -

7:40

7:40

Colion Noir

1 hour agoArmed 7-Eleven Clerk Shoots Attacker & Gets Fired

6.26K21 -

2:07:24

2:07:24

Side Scrollers Podcast

4 hours agoAsmongold/DSP RESPONSE + Kaceytron’s Life IMPLODES + Lunduke Gets Threats + More | Side Scrollers

94.4K4 -

2:22:52

2:22:52

Steven Crowder

6 hours agoDonald Vs. Ilhan: Trump Boots Somalis and The Meltdown is Glorious

463K334 -

1:04:37

1:04:37

Sean Unpaved

4 hours agoIs Lane Kiffin Staying At Ole Miss Or LEAVING For LSU? | UNPAVED

19.5K -

29:48

29:48

The White House

4 hours agoPresident Trump and The First Lady Participate in the Thanksgiving Turkey Pardoning

37.4K24 -

1:58:04

1:58:04

The Charlie Kirk Show

3 hours agoMark Kelly Court Martial + AI Embargo + Thanksgiving | Davis, Federer, Newcombe | 11.25.2025

74.7K21 -

53:20

53:20

The Rubin Report

5 hours agoLara Trump Destroys Bill Maher’s Narrative w/ Facts in 1 Minute

54.5K60