Premium Only Content

Why the Stock Market Hasn’t Crashed Yet — What Banks Don’t Want You To Know

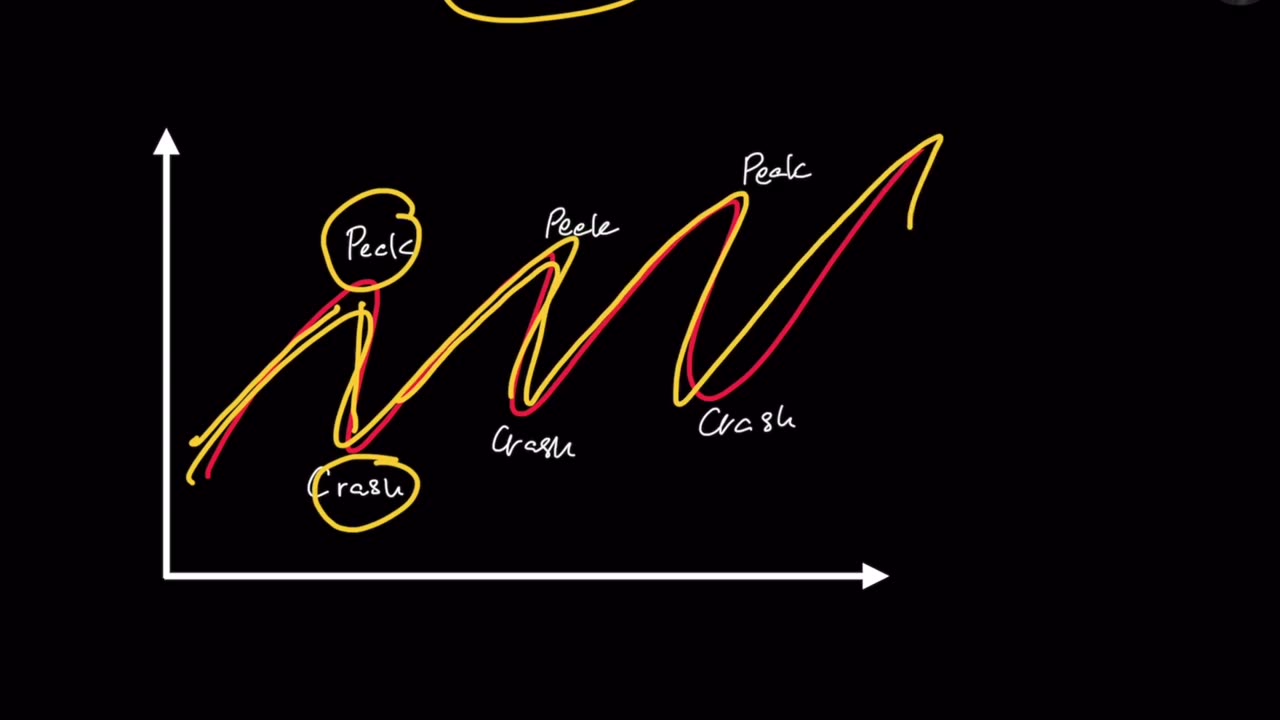

The U.S. stock market looks strong on the surface — but behind the scenes, the foundation is weakening. Households are struggling with debt, savings are draining, inflation continues to squeeze budgets, and corporations are slowing down. So why hasn’t the market crashed yet?

This video exposes the hidden forces artificially holding the market up, and why banks, hedge funds, and policymakers don’t want the public to understand what’s really happening.

We break down:

How liquidity support is being quietly injected into the financial system

Why corporate stock buybacks are propping up share prices

How government spending is masking economic weakness

Why retail investors are being encouraged to “stay bullish”

How banks are offloading risk onto the public through passive investing

The psychological strategy of maintaining confidence at all costs

The market is not rising because the economy is strong.

It’s rising because it must — or confidence collapses.

But confidence-based markets don’t fade slowly.

They snap.

This situation has happened before:

Before 2000

Before 2008

Before every major correction in history

The same signals are appearing again.

👍 Like

💬 Comment your thoughts

🔔 Follow for real economic analysis without the corporate filter

-

1:04:37

1:04:37

Sean Unpaved

4 hours agoIs Lane Kiffin Staying At Ole Miss Or LEAVING For LSU? | UNPAVED

19.5K -

29:48

29:48

The White House

4 hours agoPresident Trump and The First Lady Participate in the Thanksgiving Turkey Pardoning

37.4K24 -

1:58:04

1:58:04

The Charlie Kirk Show

3 hours agoMark Kelly Court Martial + AI Embargo + Thanksgiving | Davis, Federer, Newcombe | 11.25.2025

74.7K21 -

53:20

53:20

The Rubin Report

5 hours agoLara Trump Destroys Bill Maher’s Narrative w/ Facts in 1 Minute

54.5K60 -

56:32

56:32

TheAlecLaceShow

3 hours agoGuest: Rep. Tim Burchett | Ukraine Russia Peace Deal | Trump SLAMS Seditious 6 | The Alec Lace Show

23.2K1 -

LIVE

LIVE

LFA TV

17 hours agoLIVE & BREAKING NEWS! | TUESDAY 11/25/25

1,575 watching -

1:08:44

1:08:44

VINCE

7 hours agoThe Deep State Strikes Back! (Guest Host Shawn Farash) | Episode 176 - 11/25/25 VINCE

239K170 -

2:14:00

2:14:00

Benny Johnson

6 hours agoIt's All True, The 2024 Election Was Ready To Be Rigged. The REAL Story of How Trump-Elon STOPPED It

83.9K110 -

1:46:09

1:46:09

The Mel K Show

4 hours agoMORNINGS WITH MEL K - A Republic.. If You Can Keep It! 11-25-25

34K10 -

1:46:25

1:46:25

The Shannon Joy Show

5 hours agoDOGE Is DEAD * Trump’s Golden Economy Implodes * LIVE Exclusive With Galileyo CEO Brett Miller

18.3K7