Premium Only Content

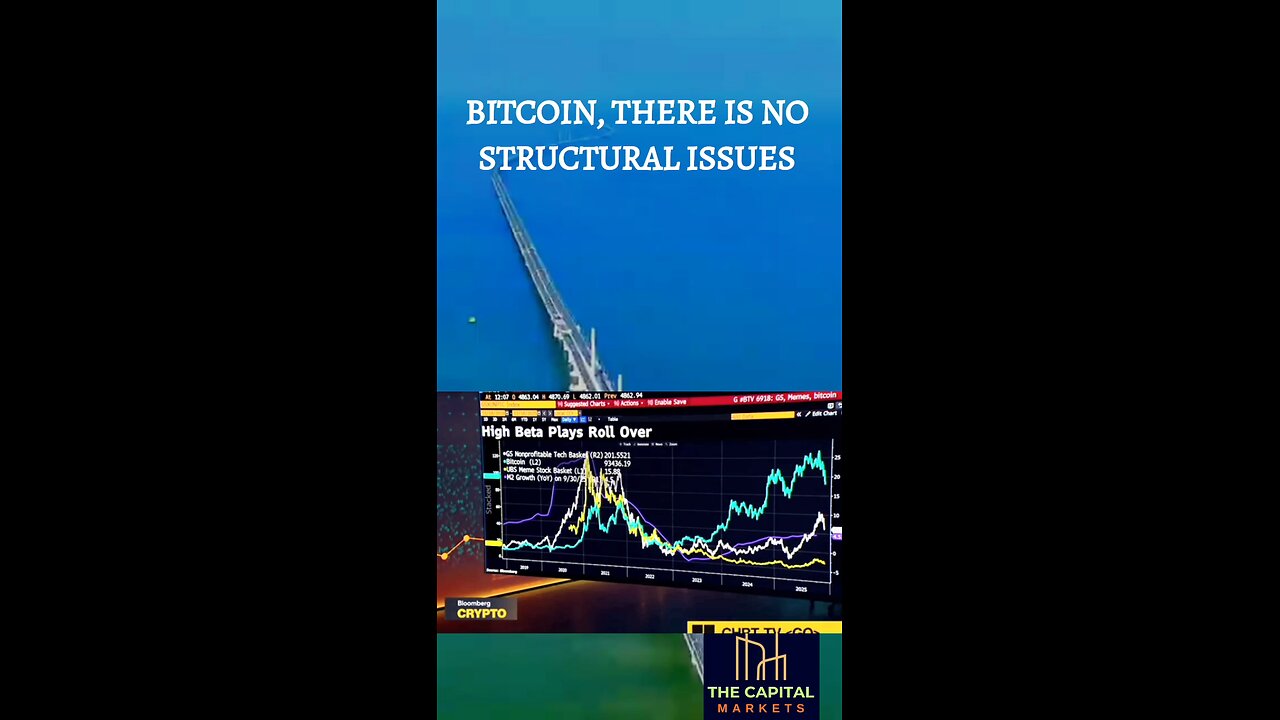

BITCOIN, THERE'S NO STRUCTURAL ISSUES

In a volatile market update from November 18, 2025, Bloomberg Crypto reports that Bitcoin has plummeted 25% from its early October highs, recently trading below $90,000 after a 9% weekend drop. Analysts debate whether this signals the start of another “crypto winter,” attributing the downturn to excessive leverage from new financial instruments like perpetual swaps and macroeconomic pressures such as a U.S. government shutdown. Despite the current bearish sentiment and growing demand for downside hedging, some experts remain optimistic about a rebound in 2026, citing anticipated institutional capital inflows and potential fiscal stimulus as key catalysts for recovery.

Meanwhile, the NFT market continues its steep decline, with its total market cap down 80% since its 2022 peak. In response, OpenSea’s CEO outlines a strategic pivot: moving beyond non-fungible tokens to embrace the “tokenization of everything,” including fungible assets and utility-based digital products. This shift aims to broaden crypto’s appeal beyond collectors and speculators, positioning blockchain as a foundational layer for mainstream digital ownership and commerce. The segment underscores how platforms are adapting to survive a post-hype era by focusing on utility and scalability.

https://linktr.ee/thecapmarkets

for coverage along with all the latest financial news and data!

#investing #finance #moneytips #personalfinance #stockmarket

#invest #longterm #stock #money #bitcoin #financialfreedom #ipo #ai #ev

Disclaimer: Trading in financial markets involves significant risk, and there is no guarantee of profit. The information provided by any financial product or service is for educational purposes and should not be considered as financial advice. Before making any investment decisions, it's important to conduct thorough research and consult with a qualified financial advisor. Past performance is not indicative of future results. Always invest what you can afford to lose and be aware of the potential for loss in any investment strategy.

-

1:43:28

1:43:28

Steven Crowder

3 hours agoTimothy Gordon Explains: What Womanly Submission Really Means

228K110 -

UPCOMING

UPCOMING

Sean Unpaved

39 minutes agoTrinidad Chambliss Granted 6TH SEASON Of NCAA Eligibility! | UNPAVED

-

LIVE

LIVE

Timcast

1 hour agoITS OVER | Tim Pool Live

8,258 watching -

LIVE

LIVE

Dr Disrespect

1 hour ago10–0. ONE RUN TO 25. | Warzone

1,013 watching -

9:53

9:53

Dr. Nick Zyrowski

2 days agoProbiotic Benefits | Top Signs You Should Be Taking A Probiotic

3.88K -

BonginoReport

2 hours agoRapper Cardi B Comes After ICE Agents - Scrolling w/ Hayley (Ep. 235) - 02/13/26

58.2K24 -

1:46:52

1:46:52

The Dan Bongino Show

4 hours agoObama's Fixer Is Back In The News (Ep. 2452) - 02/13/2026

443K396 -

43:52

43:52

The Rubin Report

2 hours agoCNN Panel Melts Down Over Liberal Racism Against the SAVE Act

31.9K13 -

LIVE

LIVE

LFA TV

15 hours agoLIVE & BREAKING NEWS! | FRIDAY 2/13/26

3,352 watching -

LIVE

LIVE

The Mel K Show

1 hour agoMORNINGS WITH MEL K - Order out of chaos? Technocracy Rising 2-13-26

858 watching