Premium Only Content

What If This Isn’t a Bubble After All?

Is the stock market really in a bubble… or are we all just falling for the same fear headlines again? Today I’m breaking down what actually constitutes a bubble, how real bubbles behave, and whether today’s market meets ANY of the classic criteria. Spoiler: the data might surprise you.

📈 We look at valuation levels, earnings strength, AI growth, liquidity trends, and retail investor behavior to answer the only question that matters:

👉 Are we in a bubble… or is this just a new market cycle forming?

If you want real analysis without the panic, you’re in the right place.

⏱️ Timestamps

0:00 — The Bubble Panic Returns

0:20 — Why Everyone Thinks We’re in a Bubble

2:00 — What a REAL Bubble Actually Looks Like

4:00 — Comparing Today’s Market vs Historical Bubbles

7:00 — The Truth: We’re Not Used to Good News

9:00 — What Would a Real Bubble Look Like From Here?

10:00 — Final Thoughts + My Verdict

10:20 — Outro & Next Steps

🔍 What You’ll Learn

The 4 traits every real bubble shares

Why valuations today aren't comparable to dot-com

How earnings and cash flow support today’s market

What a mania really looks like (and why we aren’t close)

How psychology tricks investors into calling everything a bubble

The signals that WOULD confirm a bubble

📚 Sources Mentioned / Articles

Goldman Sachs – Why Global Stocks Are Not Yet in a Bubble

J.P. Morgan – Is the U.S. Equity Market in a Bubble?

Russell Investments – Bursting the Myth: Understanding Market Bubbles

GMO – Quarterly Letter: “AI Looks Like a Classic Investment Bubble” (contrarian view)

ClearBridge – Bubble or Boom?

🚀 Support the Channel

If you want high-quality market breakdowns without the fearmongering, hit Like, Subscribe, and drop a comment below:

Do YOU think we’re in a bubble? Why or why not?

📈 Welcome to Fatal Investing — your weekly edge on the stock market, options trading, and wealth-building strategies.

Every week, we break down:

✅ Market trends and macroeconomic events

✅ Smart money moves from hedge funds and institutions

✅ Options strategies with defined risk and high ROI

✅ Passive income ideas using dividend ETFs like $JEPI and $JEPQ

✅ Real-world trades on $SPY, $QQQ, $SMH, and more

🔔 Subscribe for weekly market insights, earnings plays, and high-conviction trade setups:

➡️https://www.youtube.com/@Fatalinvesting

🎁 FREE Tools & Resources:

• 📊 Stock Picks Sheet → https://docs.google.com/spreadsheets/d/1eBKJd4_eXwTUQQNkxtkThsQgujsFGKHU-2WGVisBd8g/edit?usp=sharing

• 🧮 Free Cash Flow Calculator → https://youtu.be/rxknrwSCCuE

• 💬 Join the Discord → https://discord.gg/vBVN37facR

📺 Watch More:

• Fatal Investing (YouTube) → https://www.youtube.com/channel/UCxw2x_vcYNsFTwWoEh_0xN

• Fatal Investing (Rumble) → https://rumble.com/c/c-965347

🎵 Music Channel:

• YouTube → https://www.youtube.com/channel/UCT3TM6VqYjA5kOMhNuyOhkg

• Rumble → https://rumble.com/c/c-969787

⚠️ DISCLAIMER:

Fatal Investing is for educational and informational purposes only. We are not registered financial advisors. All investing involves risk, including loss of principal. Do your own research and consult a licensed financial professional before making any decisions.

#StockMarket #OptionsTrading #JEPI #SmartMoney #PassiveIncome #FinancialFreedom #FatalInvesting #QQQ #DividendInvesting #MarketNews

-

13:58

13:58

Fatal Investing

8 days agoSanta Claus Rally IGNITES! Nasdaq +2.5% — Chip Stocks Take Over!

831 -

2:52:10

2:52:10

TimcastIRL

5 hours agoDrunk Raccoon Becomes Top US Story After Getting Plastered, Passing Out In Bathroom | Timcast IRL

210K81 -

LIVE

LIVE

SpartakusLIVE

7 hours agoRule #1 - The BEST Loot is ALWAYS in the OTHER GUY'S BAG

607 watching -

2:16:27

2:16:27

ThatStarWarsGirl

4 hours agoTSWG LIVE: CHRISTMAS IS COMING! Stargate's BACK & DC is Doomed?!

16.9K3 -

2:38:16

2:38:16

I_Came_With_Fire_Podcast

12 hours agoDid Pete Hegseth Commit WAR CRIMES | No more INCOME TAX | More Fraud in Minnesota W/ Mike Caldarisie

20K9 -

1:32:30

1:32:30

Adam Does Movies

7 hours ago $0.55 earnedTalking Movies + Ask Me Anything - LIVE

16.5K1 -

2:12:14

2:12:14

TheSaltyCracker

5 hours agoWar Crimes ReeEEStream 12-03-25

72.1K145 -

1:31:59

1:31:59

Glenn Greenwald

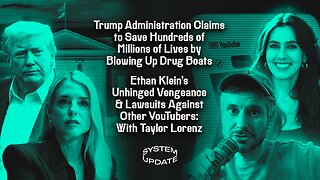

6 hours agoTrump Administration Claims to Save Hundreds of Millions of Lives by Blowing Up Drug Boats; Ethan Klein's Unhinged Vengeance & Lawsuits Against Other YouTubers: With Taylor Lorenz | SYSTEM UPDATE #553

104K133 -

19:14

19:14

MetatronCore

21 hours agoHow Propaganda works on your Brain

16.4K6 -

1:26:32

1:26:32

Joker Effect

3 hours agoWHO IS TYSON HOCKLEY?! What does the IRL streaming space look like? WHY IS EVERYONE SUEING EACHOTHER

7.37K