Premium Only Content

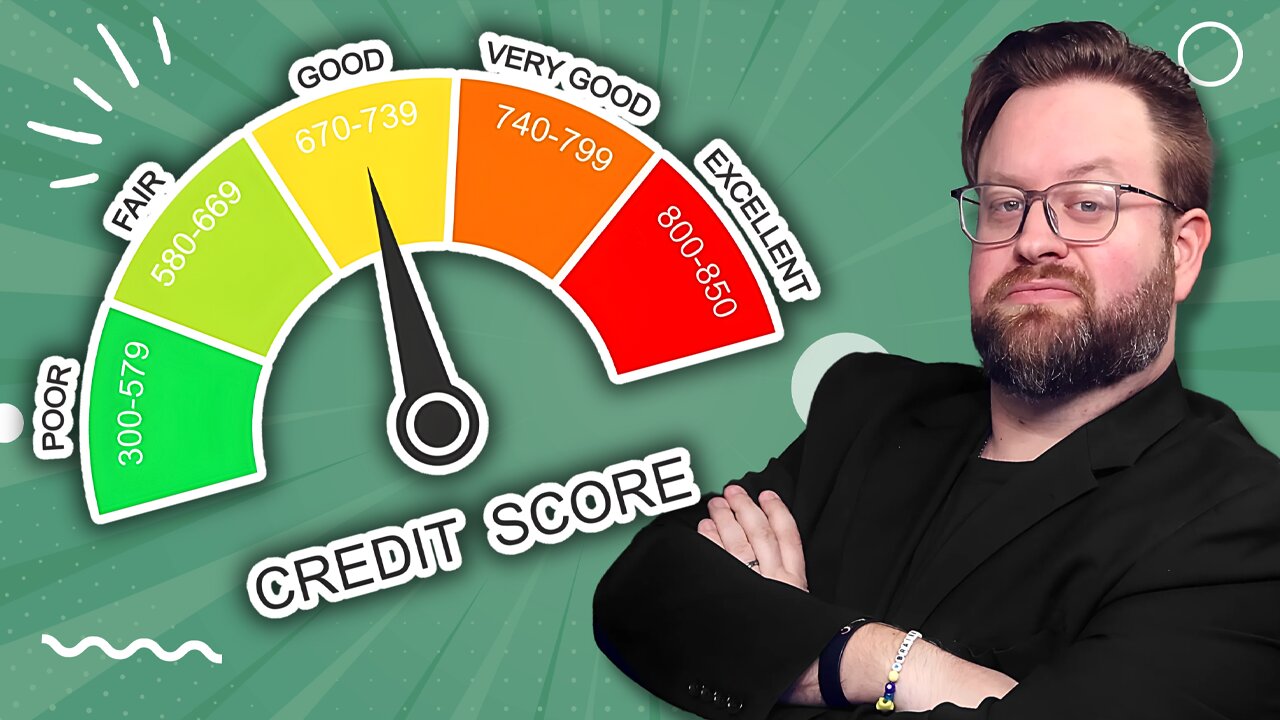

The Credit Score Revolution: What Changes in 2026 and Beyond

Pre-Qualify now to see how much funding you may qualify for: https://www.fundandgrow.com/prequalification?t=pq2&ref=youtube

The credit reporting system in the United States is changing fast — and if you rely on loans, mortgages, business credit, buy now pay later apps, or even rent payments, these changes could directly affect your score, your borrowing power, and your financial future.

In this video, we break down the biggest shifts happening right now at the credit reporting bureaus — Experian, Equifax, and TransUnion — and explain how new data, new scoring models, and new federal policies are transforming the traditional credit system.

What’s Changing in Credit Reporting?

For decades, the major credit bureaus controlled the data that determined your credit score. But today, that system is being disrupted by:

Buy Now, Pay Later reporting

Rent reporting

Alternative data and subscription payments

New automated credit scoring models

Real-time reporting technologies

Fannie Mae's decision to move away from traditional credit scores

The rise of VantageScore vs FICO

These changes could make credit scores more accurate, more inclusive, and more fair, but they also introduce risks for consumers who don’t understand how the new system works.

DISCLAIMER: "Funding" typically comes in the form of the issuance of business credit cards that may be used for business purposes. In such instances, we consider these "credit lines" and "funding" since businesses may tap those lines. Zero-Interest is based on the personal credit-worthiness of the business owner. 0% rates are introductory rates and vary in length of time, assuming all monthly required payments are made to the credit card company. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement from the lender. Fund&Grow is not a lender.

#fundandgrow #businessfunding #businesscredit

-

1:03:16

1:03:16

BonginoReport

3 hours agoTheir Excuses Aren't Working Anymore | Episode 207 - 01/20/26 VINCE

158K58 -

LIVE

LIVE

LFA TV

14 hours agoLIVE & BREAKING NEWS! | TUESDAY 1/20/26

4,333 watching -

1:23:20

1:23:20

Steve-O's Wild Ride! Podcast

4 days ago $0.49 earnedMrBeast (Jimmy Donaldson) Had A Problem With Steve-O | Wild Ride #277

16.2K12 -

LIVE

LIVE

Chad Prather

2 hours agoReaction At CFP National Championship PROVES America Is Still With Trump + Don Lemon Is IN TROUBLE!

583 watching -

6:55

6:55

Tactical Advisor

1 hour agoRadian / Canik Prime Collab Handgun (FIRST LOOK)

5.78K4 -

11:44

11:44

Scammer Payback

1 hour agoLocked Their Hard Drives, Listen to Them Rage

4.2K4 -

30:02

30:02

Rethinking the Dollar

2 hours agoSilver 3‑Bagger in Yen! The Real Money Moves Now | News Update

5.1K2 -

1:46:05

1:46:05

Graham Allen

3 hours agoTrump’s First Year! Trump Agrees To NATO Meeting For Greenland! + Dems Already Destroying Virginia!

145K507 -

LIVE

LIVE

The Big Mig™

3 hours agoAI, How Do We Protect Humanity w/ The Alliance For Secure AI

3,176 watching -

1:09:44

1:09:44

Chad Prather

14 hours agoWhen the Gospel Disrupts What We Worship

110K32