Premium Only Content

🤢 BlackRock quietly pumps Bitcoin back up after mysterious crash

The cryptocurrency owes its jolt up to $92-93.5k after bottoming out at ~$84.2k late last month to BlackRock, the global vulture fund giant, which continued adding Bitcoins to its portfolio even as other exchange-traded funds sold them off.

🔴 From November 1-December 1, BlackRock added 24.4k BTC compared to the previous quarter, says analyst Paul Hoffman.

🔴 BlackRock’s Bitcoin investment vehicle iShares now collectively owns nearly 60% of all ETF-owned Bitcoins. That’s nearly 776.5k coins out of the estimated global total of ~20M.

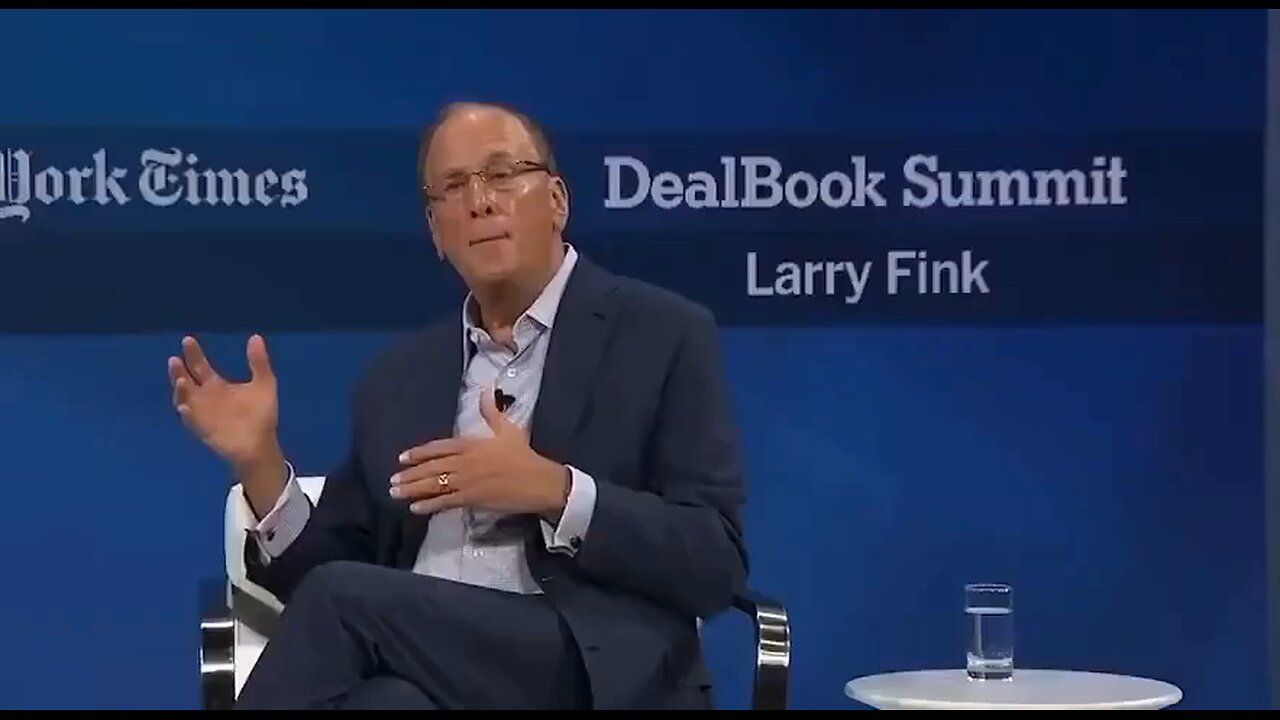

🔴 BlackRock CEO Larry Fink, who once derided Bitcoin as a tool of money launderers and criminals, now backs the cryptocurrency to the hilt, saying he sees a “big, large use case” for it. “In my role, I see thousands of clients a year. I meet with governmental leaders, and we have conversations that evolve my thinking,” he explained this week.

🔴 Fink attributed Bitcoin’s bounce-back to sovereign wealth funds, who he said were “standing by” and “adding incrementally” to their portfolios. “You own it over years. This is not a trade. You own it for a purpose,” the billionaire said, referencing Bitcoin’s seismograph style tendency to swing wildly back and forth.

The scale and speed of Bitcoin’s sudden drop last month have fueled speculation of market manipulation targeting gullible institutional investors, with BlackRock named as one potential culprit.

-

1:05:41

1:05:41

Crypto Power Hour

10 hours ago $2.74 earnedBlockchain Solutions w/ U.S. Healthcare Featuring Solum Global

21.2K9 -

1:18:24

1:18:24

The Illusion of Consensus

1 month ago“Your Math Is WRONG” - Mark Cuban GRILLED Over His NBA COVID Vaccine Mandate | Part 2

3.15K10 -

14:17

14:17

RTT: Guns & Gear

16 hours ago $2.33 earnedBest Budget RMR Red Dot 2025? Gideon Optics Granite Review

5.58K3 -

LIVE

LIVE

BEK TV

23 hours agoTrent Loos in the Morning - 12/05/2025

263 watching -

LIVE

LIVE

The Bubba Army

22 hours agoWill Michael Jordan TAKE DOWN NASCAR - Bubba the Love Sponge® Show | 12/05/25

1,323 watching -

35:55

35:55

ZeeeMedia

15 hours agoPfizer mRNA in Over 88% of Human Placentas, Sperm & Blood | Daily Pulse Ep 156

10.1K104 -

LIVE

LIVE

Pickleball Now

5 hours agoLive: IPBL 2025 Day 5 | Final Day of League Stage Set for Explosive Showdowns

237 watching -

9:03

9:03

MattMorseTV

17 hours ago $19.08 earnedIlhan Omar just got BAD NEWS.

39.2K93 -

2:02:41

2:02:41

Side Scrollers Podcast

21 hours agoMetroid Prime 4 ROASTED + Roblox BANNED for LGBT Propaganda + The “R-Word” + More | Side Scrollers

142K15 -

16:38

16:38

Nikko Ortiz

16 hours agoVeteran Tactically Acquires Everything…

27.3K1