Premium Only Content

2026 PREDICTION

The 2026 market outlook anticipates a continuation of the bull market, albeit with

https://linktr.ee/thecapmarkets

slower momentum—described as the bull “taking a nap”—before potentially reaccelerating in 2027–2028. Sector rotation is expected, with materials and the energy sector (particularly XLE, supported by ExxonMobil’s resilience despite sub-$60 crude) highlighted as areas to watch, though not for explosive gains. Healthcare, especially medical devices and biotech, shows promise, with anticipated M&A activity and continued strength in the IBB ETF; Biogen (BIIB) is singled out as a top pick. The macro backdrop will initially be shaped by Federal Reserve policy but shift toward political uncertainty as the 2026 U.S. midterm elections approach, historically a volatile period. Additionally, a pending Supreme Court decision on tariffs—potentially landing in early 2026—could introduce further market turbulence if tariffs are ruled illegal, underscoring that uncertainty remains a key risk the market strongly dislikes.

https://linktr.ee/thecapmarkets

for coverage along with all the latest financial news and data!

#investing #finance #moneytips #personalfinance #stockmarket

#invest #longterm #stock #money #bitcoin #financialfreedom #ipo #ai #ev

Disclaimer: Trading in financial markets involves significant risk, and there is no guarantee of profit. The information provided by any financial product or service is for educational purposes and should not be considered as financial advice. Before making any investment decisions, it's important to conduct thorough research and consult with a qualified financial advisor. Past performance is not indicative of future results. Always invest what you can afford to lose and be aware of the potential for loss in any investment strategy.

-

LIVE

LIVE

The Jimmy Dore Show

3 hours agoTucker CALLS OUT Fake Pastors’ Israel Support! Trump Announces LAND ATTACKS on Venezuela!

10,742 watching -

LIVE

LIVE

SpartakusLIVE

3 hours agoMonday MOTIVATION || Almost at PRESTIGE MASTER

225 watching -

LIVE

LIVE

Nikko Ortiz

2 hours agoBurkina Faso Looks Very Interesting... | Rumble LIVE

159 watching -

LIVE

LIVE

Mally_Mouse

7 hours ago🎄🎮 Let's Play!!: - Fortnite

167 watching -

52:19

52:19

Donald Trump Jr.

5 hours agoNick Shirley Live , We’re “Learing” More & More | Triggered Ep. 303

130K167 -

LIVE

LIVE

Saycred Angel Live

5 hours ago!HOUSE😈NO MERCY MONDAY😈!GIVEAWAY

57 watching -

56:04

56:04

vivafrei

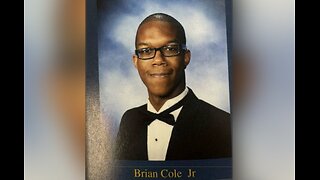

3 hours agoTim Walz Appoints "Outside Firm" to Audit Fraud! DOJ Wants to Detain Brian Cole Jr. PENDING TRIAL!

23.6K38 -

LIVE

LIVE

JdaDelete

3 hours agoWild Arms (PS1) | Episode 6 | Ka Dingel

229 watching -

LIVE

LIVE

DeadMomAlive

4 hours agoALAN WAKE 2 Virgin Pt 3 I PREMIUM CREATOR!!

41 watching -

![ARC RAIDERS AND THINGS [RGMT CONTENT Mgr. | RGMT GL | GZW CL]](https://1a-1791.com/video/fww1/36/s8/1/W/Y/4/L/WY4Lz.0kob-small-ARC-RAIDERS-AND-THINGS-RGMT.jpg) LIVE

LIVE

XDDX_HiTower

37 minutes agoARC RAIDERS AND THINGS [RGMT CONTENT Mgr. | RGMT GL | GZW CL]

38 watching