Premium Only Content

New Files Show Epstein Was ‘Too Useful’ for Banks to Drop

The newest Epstein disclosures include deposition testimony that illustrates, in unusually concrete detail, how major financial institutions assessed risk, value, and accountability.

The transcript does not add new allegations about Epstein. Instead, it explains why he remained bankable long after his 2008 conviction and why his relationship with major banks survived despite generating almost no traditional revenue.

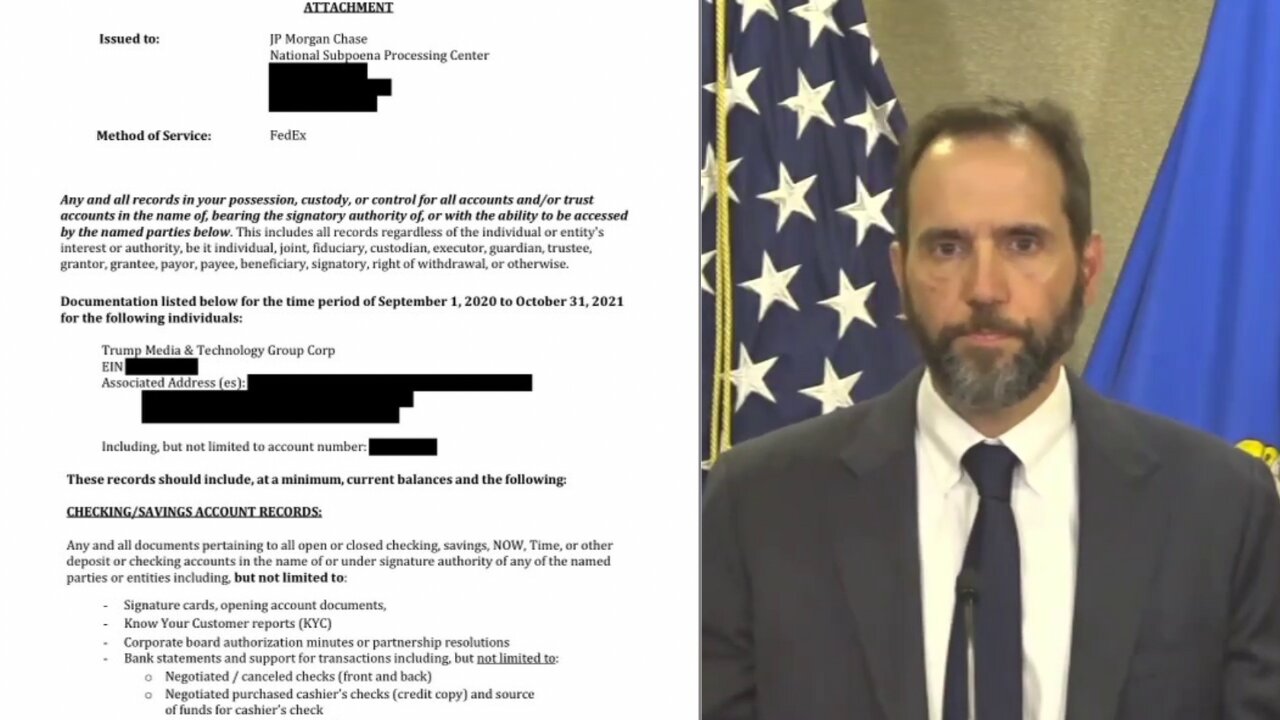

That institutional logic is the same logic that later drove JPMorgan to end its ties with Trump Media, and the contrast between the two cases shows how selectively these standards are applied.

In the deposition, Paul Morris—a private banker who handled Epstein’s accounts at JPMorgan Chase and later Deutsche Bank—described Epstein’s financial profile with unusual precision.

-

1:14

1:14

GREGORY LYAKHOV

15 days agoTim Walz CLOSED DHS Website in Minnesota

15 -

![[Ep 827] Protests, Riots, or Terror? | All-Star Guest Line-Up!!](https://1a-1791.com/video/fww1/d9/s8/1/I/P/-/Q/IP-Qz.0kob-small-Ep-827-Protests-Riots-or-Te.jpg) 3:00:15

3:00:15

The Nunn Report - w/ Dan Nunn

4 hours ago[Ep 827] Protests, Riots, or Terror? | All-Star Guest Line-Up!!

24K4 -

1:10:22

1:10:22

The Tom Renz Show

3 hours agoJustice For J6? Not Without someone Growing a Spine!

32K8 -

1:46:52

1:46:52

The Quartering

6 hours agoLEFTISTS HAVE LOST THE NARRATIVE ON ICE RAIDS & THEY ARE DESPERATE!

231K121 -

DVR

DVR

StoneMountain64

6 hours agoArc Raiders Osprey Sniping and PVP Friday

32.6K1 -

31:40

31:40

Tucker Carlson

7 hours agoEva Vlaardingerbroek Speaks Out After Being Banned From the UK

80.4K204 -

LIVE

LIVE

GritsGG

4 hours agoWin Streak Camo TODAY! #1 Warzone Victory Leaderboad 782+ Ws!!🔥

50 watching -

1:32:55

1:32:55

Simply Bitcoin

7 hours ago $1.85 earnedThe Wall Street Bitcoin suppression continues: PAY ATTENTION | EP 1420

30.9K2 -

9:42

9:42

Clintonjaws

8 hours ago $1.78 earnedEntire Room Speechless as Karoline Leavitt Snaps & Destroys All Media To Their Face

12.3K17 -

59:47

59:47

Jeff Ahern

4 hours ago $0.47 earnedFriday Freak out with Jeff Ahern

8.66K3