Premium Only Content

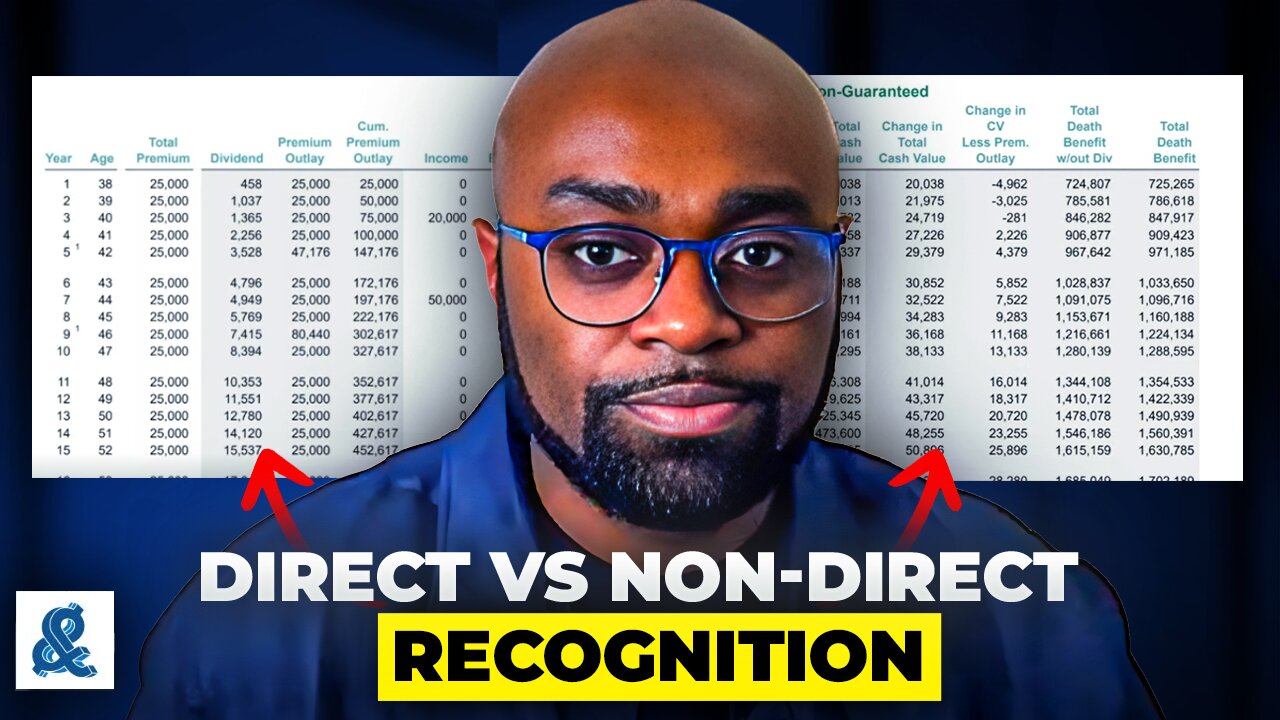

Choosing the Right Policy for Infinite Banking | Direct vs Non-Direct Recognition (REAL CASE STUDY)

It's common practice to use non-direct recognition whole life insurance but is it the best policy to use for infinite banking? In this video, Demetrius Walker shows a real case study comparing Direct vs Non-Direct Recognition policies between Penn Mutual and Lafayette Life Insurance Companies. The answer may surprise you.

Want Whole Life Insurance? Click Here To Meet Our Team: https://bttr.ly/aa-yt-clarity

Want Us To Review Your Life Insurance Policy? Click Here: https://bttr.ly/yt-policy-review

Want Free Life Insurance Education & Resources? Unlock the Vault: https://bttr.ly/yt-aa-vault

Learn More About the And Asset: https://bttr.ly/andasset

0:00 Introduction: Direct vs. Non-Direct Recognition Comparison

0:24 Misconception about Direct Recognition

0:57 Case Study Setup

1:10 Comparison (Pen Mutual vs. Lafayette Life)

3:04 Penn Mutual with Loan Activity

4:47 Lafayette Life with Loan Activity

5:47 Key Takeaways

6:39 Why This Matters for the Client

7:22 The Real Takeaway

7:42 Scheduling a Clarity Call with BetterWealth

======================

DISCLAIMER: https://bttr.ly/aapolicy

*This video is for entertainment purposes only and is not financial or legal advice.

Financial Advice Disclaimer: All content on this channel is for education, discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation. Should you need such advice, consult a licensed financial or tax advisor. No guarantee is given regarding the accuracy of information on this channel. Neither host or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

-

48:21

48:21

And Asset

1 month agoCompounding Vs Amortizing Interest for Infinite Banking | And Asset Show Ep 18

111 -

LIVE

LIVE

Wokkopotamus

1 hour agoIts Assassins Sunday with Wokko and then we raid to Rotella streams Date night

181 watching -

1:19:06

1:19:06

Mike Krabal

29 days agoBuilding My Best Camper Yet. Start to Finish!

99.4K28 -

LIVE

LIVE

tacetmort3m

10 hours ago🔴 LIVE - LIVE BY THE GOOP - ARC RAIDERS

104 watching -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

286 watching -

53:50

53:50

Squaring The Circle, A Randall Carlson Podcast

1 day agoWhat Is Earth's "Second Moon" and Why Is It Important?

24.7K17 -

2:57:00

2:57:00

Boxin

4 hours agoI'm Back ! Tomb Raider 2 remastered!

22.6K -

LIVE

LIVE

IamNibz

14 hours ago $0.34 earnedVintage Story With The Boys (Ft. VladsGamingCartel And LateNightRamblings)

110 watching -

LIVE

LIVE

dieseldesigns

4 hours agoBuilding a Farm House & MORE! | Hytale

77 watching -

1:30:54

1:30:54

RCAM

4 hours agoARC Raiders | Trials | Gaming on Rumble

19.6K1