Premium Only Content

The Conservative Investor Blueprint

The Conservative Investor Blueprint: Securing Your Future

Are you in your late 50s and looking for a way to protect your wealth while maximizing your retirement income? In this video, we break down the "Conservative Investor Quadpod"—a 4-pillar strategic framework designed for capital preservation, tax efficiency, and long-term security.

Many investors focus only on growth, but in the German tax and healthcare system, "protection" is just as important as "profit." We’ll show you how to structure your assets so they are shielded from the Finanzamt (Tax Office) and rising healthcare costs.

What we cover in this blueprint:

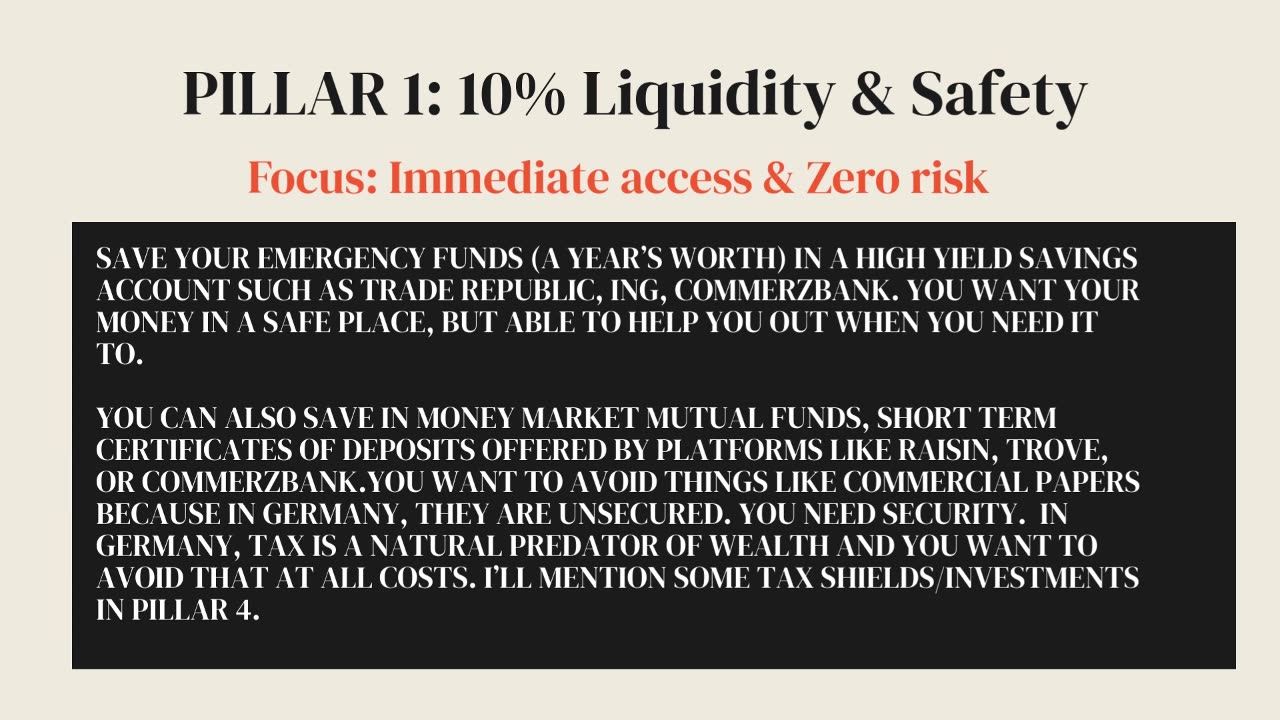

Pillar 1: Liquidity & Safety – Why a 15% cash bridge is your ultimate defense against market volatility.

Pillar 2: The Guaranteed Income Brackets– Integrating Government Bonds, Fixed Annuities, State Pensions etc to create a check you can’t outlive.

Pillar 3: Defensive Growth – How to use low-volatility ETFs and dividend stocks to beat inflation without unnecessary risk.

Pillar 4: Legacy and Protection – The "missing link" of private pensions, health insurance, and why Inheritance Contract is better than a simple Will, in Germany.

Key Highlights for Late-50s Investors:

✅ How to get an immediate 40%+ tax refund using the Rürup "Tax Shield." ✅ Why a 0% allocation to protection is the biggest risk to your legacy.

✅ The difference between "Freedom" (Private Pensions) and "Security" (Base Pensions).

If you are a Nigerian living in Germany, this is the essential roadmap to ensure your hard-earned wealth follows your rules, not the state's.

Go to - https://equilibrada.xyz/the-wealth-sh... to find out what type of investor you are.

Disclaimer: This video is for informational purposes only and does not constitute individual tax or legal advice. Please consult with a certified financial planner (CFP) or a notary for specific German legal requirements.

-

9:53

9:53

Dr. Nick Zyrowski

2 days agoProbiotic Benefits | Top Signs You Should Be Taking A Probiotic

18K -

1:07:44

1:07:44

BonginoReport

3 hours agoRapper Cardi B Comes After ICE Agents - Scrolling w/ Hayley (Ep. 235) - 02/13/26

83.9K35 -

1:46:52

1:46:52

The Dan Bongino Show

5 hours agoObama's Fixer Is Back In The News (Ep. 2452) - 02/13/2026

511K530 -

43:52

43:52

The Rubin Report

3 hours agoCNN Panel Melts Down Over Liberal Racism Against the SAVE Act

46K30 -

LIVE

LIVE

LFA TV

17 hours agoLIVE & BREAKING NEWS! | FRIDAY 2/13/26

2,092 watching -

1:44:55

1:44:55

The Mel K Show

2 hours agoMORNINGS WITH MEL K - Order out of chaos? Technocracy Rising 2-13-26

24.8K6 -

34:10

34:10

Tudor Dixon

3 hours agoBig Tech on Trial, Section 230 & Social Media Harm Debate | The Tudor Dixon Podcast

13.7K1 -

19:19

19:19

Robbi On The Record

4 hours ago $2.57 earnedWhy You’re Tired, Stressed & Gaining Weight

17.9K3 -

1:32:32

1:32:32

Graham Allen

5 hours agoWill Epstein Cost Us the MIDTERMS??! + It's a New World and It's Time For Us To Fight the RIGHT Way!

187K248 -

20:03

20:03

Clintonjaws

13 hours ago $6.59 earnedTV Host Explodes At Woke Guest For Defending Men on Women's Toilets!

33K19