Premium Only Content

Decoding U.S. Tax Laws: Insights from Experts

Employee Withholding and Tax Questions

The discussion revolves around various questions related to employee withholding and tax filing issues.

• Mark Lucas poses questions from a Telegram group regarding tax withholding and filing.

• Key questions include how to stop employee withholding, potential consequences of not filing, and responses to tax authority requests.

• The answers suggest that stopping withholding is often temporary and may lead to scrutiny from tax authorities.

• The IRS can issue a lock-in letter, which mandates a single zero withholding status, despite lacking statutory authority.

Understanding the Income Tax Structure

The conversation delves into the historical context and structure of the income tax system in the U.S.

• Larry Becraft explains the evolution of the income tax through three distinct periods: 1918-1928, 1928-1954, and post-1954.

• The 1913 Tariff Act and subsequent acts are discussed, emphasizing their relevance to understanding current tax liabilities.

• The withholding agent is identified as the party liable for income tax, particularly for non-resident aliens and foreign corporations.

• The importance of understanding the interrelationship of tax laws over time is highlighted.

Legal Implications and Risks in Tax Advocacy

The discussion touches on the legal risks associated with tax advocacy and claims.

• A case involving Larry Becraft is mentioned, where he faced sanctions for advocating claims deemed frivolous by the court.

• The conversation emphasizes the need for caution in making legal claims regarding tax liabilities.

• The potential for individuals to misinterpret tax laws and act prematurely is noted as a significant risk.

Educational Approaches to Tax Understanding

The need for educational resources and guidance in understanding tax laws is emphasized.

• There is a suggestion to create educational materials to help individuals navigate complex tax laws.

• The importance of careful research and understanding before taking action is stressed to avoid legal pitfalls.

• The group aims to foster a collaborative effort to finance projects that enhance understanding of tax issues.

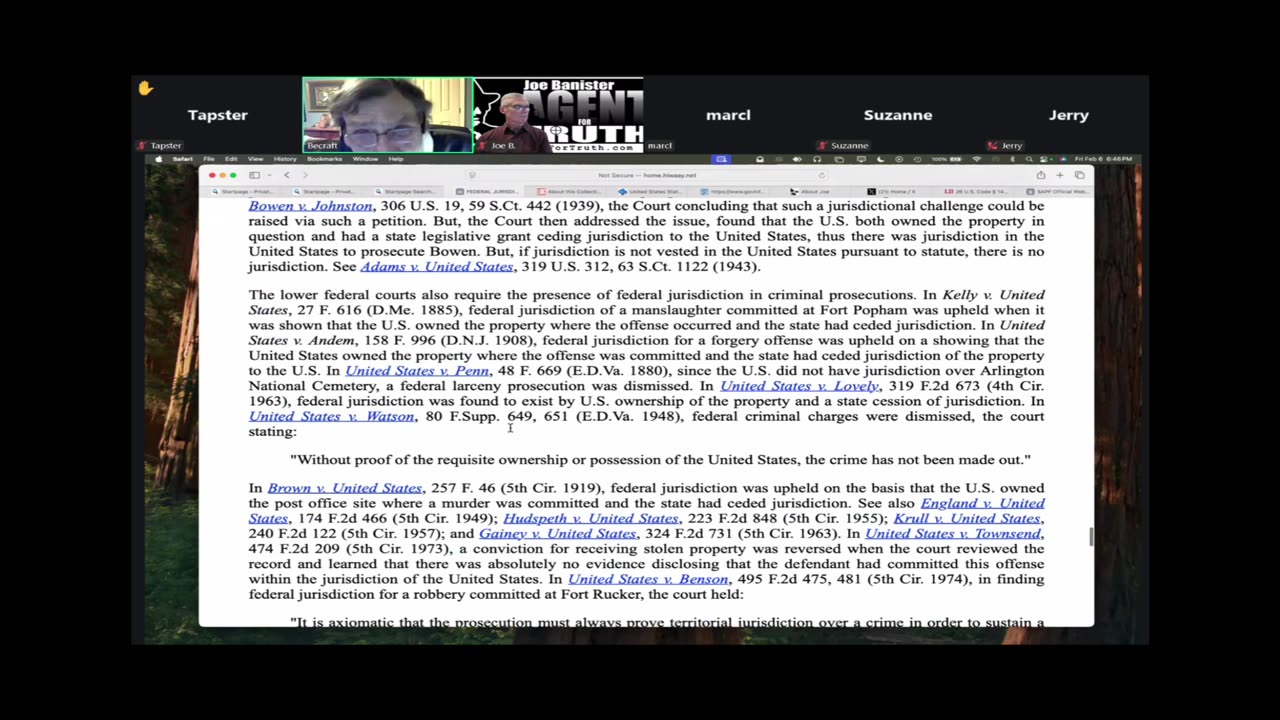

Jurisdiction and Territorial Laws

The discussion revolves around the territorial nature of U.S. laws and how it affects legal cases.

• U.S. laws are inherently territorial, limiting their jurisdiction.

• Article 1, Section 8, Clause 17 of the Constitution is referenced regarding federal jurisdiction.

• The case of Cleo's Funkies Express illustrates jurisdictional arguments in theft cases on military bases.

• Judges often avoid addressing these jurisdictional principles in court.

Theory of Defense in Tax Cases

The speaker emphasizes the importance of presenting a valid theory of defense in tax-related cases.

• A theory of defense jury instruction is crucial for informing juries about legal arguments.

• The speaker successfully appealed a bribery conviction based on a theory of defense regarding tax liability compromises.

• The Nelson case is highlighted as an example where jurisdictional beliefs about income tax were central to the defense.

Limitations of Federal Government Authority

The conversation highlights the limited authority of the federal government, particularly regarding taxation.

• The federal government’s jurisdiction is confined to specific territories and possessions.

• Historical context is provided, referencing the 1861 tax act and its implications on current tax laws.

• The 16th Amendment did not grant new powers of taxation, as confirmed by court cases.

Recent Legal Developments and Cases

Recent court cases challenge the authority of the IRS and the federal government regarding tax regulations.

• Two recent cases in Alabama and Texas found certain IRS regulations unconstitutional.

• The Treasury Department dropped requirements for businesses to report beneficial ownership after court rulings.

• The importance of understanding the limits of federal authority is emphasized for tax movement advocates.

Personal Experiences with IRS Communications

Participants share their personal experiences with the IRS regarding tax liability and revocation of elections.

• One participant received a response from the IRS stating, "there is nothing further for you to do" after revoking their election.

• Another participant's friend received a tax refund after similar actions, highlighting inconsistencies in IRS responses.

• Caution is advised as past experiences show that IRS communications can change over time, leading to potential liabilities.

-

LIVE

LIVE

iCkEdMeL

31 minutes ago🔴 BREAKING: Savannah Guthrie Speaks Out as Burglary Theory Grows | YouTubers vs Journalists

153 watching -

2:02:07

2:02:07

Nerdrotic

2 hours ago $12.29 earnedKentucky Goblins | Forbidden Frontier #129

88.4K3 -

2:23:43

2:23:43

vivafrei

10 hours agoEp. 303: Barnes to Sue Mike Davis? Epstein, Bannon, Alex Jones, Texas, D.C. Corruption AND MORE!

87K44 -

LIVE

LIVE

Akademiks

5 hours agoVLAD Exposes JAY Z, Roc Nation and the industry. THE TRUTH Finally Explained - THE JAYSTEIN FILES!

2,339 watching -

LIVE

LIVE

EricJohnPizzaArtist

3 days agoAwesome Sauce PIZZA ART LIVE Ep. #80: “Duke” the Dog!

79 watching -

LIVE

LIVE

IsaiahLCarter

1 day agoLogan Lancing: The Second Grandmaster || APOSTATE RADIO 044

96 watching -

LIVE

LIVE

SpartakusLIVE

2 hours agoGames w/ Rallied || #1 BIGGEST BICEPS and MAXIMUM FIVEHEAD

123 watching -

14:08

14:08

LegallyArmedAmerica

1 day ago $0.83 earnedEXPOSED: Your child is being tracked and you're paying for it

8.04K5 -

LIVE

LIVE

RealMetatron

4 hours agoMEGA Live Stream

147 watching -

LIVE

LIVE

MojoxGames

3 hours ago💥NEW GAME TO TRY💥 / DELTA FORCE / SUB FOR NO ADS

57 watching