Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Calculating the Implied Volatility of a Put Option Using Python

5 years ago

10

In answer to a question, I wanted to show how to calculate the implied volatility of a put option. The code I had used previously was only for a call. I want to emphasize that the method used here is much more general than just a tool to calculate volatility and so before moving on to puts, I show how to modify the code for a function I made up on the spot.

Original Video on root-finding and implied volatility: https://youtu.be/Jpy3iCsijIU

Video on issues with ITM options whose price is less than its intrinsic value: https://youtu.be/2UJ9kFqQF-s

Github: https://github.com/kpmooney/numerical_methods_youtube/tree/master/root_finding/implied_volatility

Tip Jar: http://paypal.me/kpmooney

Loading comments...

-

21:36

21:36

kpmooney

5 years agoCalculating Implied Volatility from an Option Price Using Python

135 -

13:26

13:26

kpmooney

5 years agoCalculating the Implied Volatility of an Option with Excel (or Google Sheets)

115 -

13:14

13:14

kpmooney

5 years agoDebugging the Python Implied Volatility Code

28 -

14:53

14:53

kpmooney

5 years agoGenerating Option Payoff Plots in Python

108 -

12:34

12:34

kpmooney

5 years ago $0.01 earnedCalculating Probability of Making 50% of Max Profit on a Short Strangle Using Python

45 -

7:52

7:52

monsterMatt

5 years agoPython Importing and Using Classes

192 -

4:56

4:56

monsterMatt

5 years agoImporting and Using Custom Classes in Python

114 -

18:24

18:24

kpmooney

5 years agoProbability of a Touch in Finance using Python Monte Carlo Methods

41 -

2:04

2:04

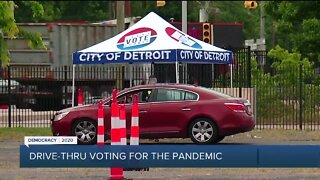

WXYZ

5 years agoResidents using drive-thru voting option for Primary Election

117 -

8:43

8:43

Matea Vasileski

5 years agoCreate a Map of UFO Reports Using Python and Plotly in Under 10 Minutes

16