Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

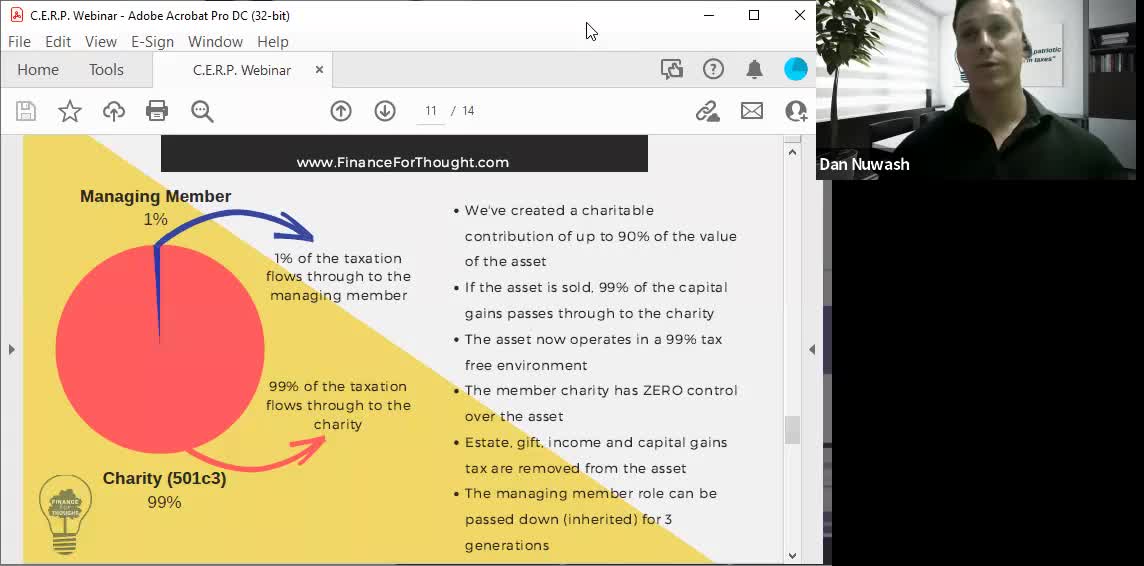

Recorded Webinar: How to Eliminate 99% of Capital Gains Tax Using a C.E.R.P.

3 years ago

14

A Charitable Estate Replacement Plan (CERP) is an advanced and proprietary tax strategy that can provide the following benefits:

-A current income tax deduction which avoids up to 50% of your total tax (with a 5 year carry forward)

-Assets contributed grow without tax

-Appreciated assets contributed can be sold or liquidated without tax

-Assets are exempt from gift and estate tax

-Assets are creditor and divorce protected

-Client and heirs maintain total control over the assets in a C.E.R.P.

-Client and heirs will make substantial charitable gifts to their preferred designated charities

Loading comments...

-

5:48

5:48

One America News Network

3 years agoTipping Point - Stephen Moore - Yellen Proposes Unrealized Capital Gains Tax

1.31K14 -

1:02

1:02

BonginoReport

3 years agoBiden Admin Pitches Taxing Unrealized Capital Gains

37.6K159 -

1:02

1:02

Dinesh D'Souza

3 years agoSec Of The Treasury Wants To Tax Unrealized Capital Gains

4.32K -

2:28

2:28

CredoFinance

4 years agoCapital Gains Taxes on Crypto - Friday Wisdom

35 -

LIVE

LIVE

LFA TV

17 hours agoBREAKING NEWS ALL DAY! | TUESDAY 9/30/25

1,222 watching -

LIVE

LIVE

freecastle

5 hours agoTAKE UP YOUR CROSS- May the forces of evil become confused on the way to your house.

39 watching -

1:23:05

1:23:05

Awaken With JP

4 hours agoGetting NUTS! FBI Did J6, Comey Indicted, and More! - LIES ep 110

41.6K20 -

LIVE

LIVE

Pop Culture Crisis

2 hours agoJK Rowling OBLITERATES Emma Watson, Trump Vs Ariana Grande, Could The Rock be President? | Ep. 926

689 watching -

LIVE

LIVE

The HotSeat

1 hour agoCommander In Chief and SECWAR Address The Troops, and I AM HERE FOR IT!

833 watching -

![[Ep 759] Resist Digital ID | Dems to Shut Down Gov | Obama Library Funds Tides / Terrorists](https://1a-1791.com/video/fwe2/55/s8/1/8/U/L/m/8ULmz.0kob-small-Ep-759-Resist-Digital-ID-De.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

2 hours ago[Ep 759] Resist Digital ID | Dems to Shut Down Gov | Obama Library Funds Tides / Terrorists

177 watching