Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Recorded Webinar: How to Eliminate 99% of Capital Gains Tax Using a C.E.R.P.

3 years ago

14

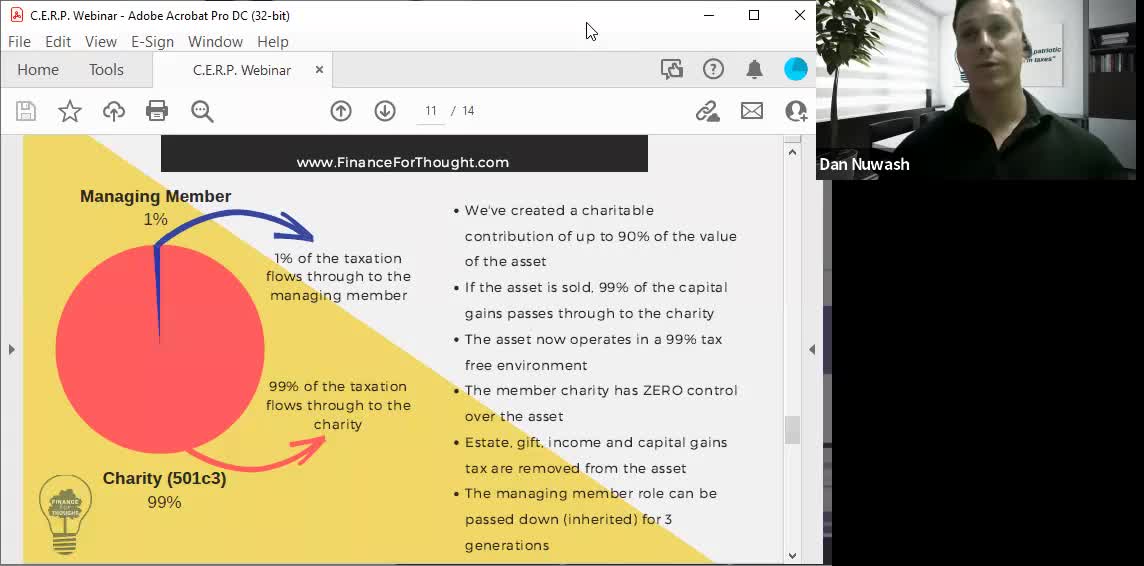

A Charitable Estate Replacement Plan (CERP) is an advanced and proprietary tax strategy that can provide the following benefits:

-A current income tax deduction which avoids up to 50% of your total tax (with a 5 year carry forward)

-Assets contributed grow without tax

-Appreciated assets contributed can be sold or liquidated without tax

-Assets are exempt from gift and estate tax

-Assets are creditor and divorce protected

-Client and heirs maintain total control over the assets in a C.E.R.P.

-Client and heirs will make substantial charitable gifts to their preferred designated charities

Loading comments...

-

5:48

5:48

One America News Network

4 years agoTipping Point - Stephen Moore - Yellen Proposes Unrealized Capital Gains Tax

1.31K14 -

1:02

1:02

BonginoReport

4 years agoBiden Admin Pitches Taxing Unrealized Capital Gains

37.6K159 -

1:02

1:02

Dinesh D'Souza

4 years agoSec Of The Treasury Wants To Tax Unrealized Capital Gains

4.32K -

2:28

2:28

CredoFinance

4 years agoCapital Gains Taxes on Crypto - Friday Wisdom

35 -

LIVE

LIVE

Badlands Media

7 hours agoBadlands Daily: November 3, 2025

2,308 watching -

LIVE

LIVE

Wendy Bell Radio

7 hours agoThings Will Get Worse Before They Get Better

6,685 watching -

LIVE

LIVE

The Big Mig™

3 hours agoICE Will Use Private Bounty Hunters, LFG

5,208 watching -

1:08:17

1:08:17

Chad Prather

10 hours agoHow to Get Along With People You Don’t Even Like (Most of the Time)

94.5K28 -

1:45:29

1:45:29

MTNTOUGH Podcast w/ Dustin Diefenderfer

9 hours agoTaya + Colton Kyle: Can American Marriages Survive 2025? | MTNPOD #140

17.3K -

1:12:23

1:12:23

MikeMac - Say Something

17 hours agoSay Something Beyond W/MikeMac: JOKER - Ep.12

19.8K1