Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Cryptocurrency Taxes: Know What You Don't Know - Part 3: Three Legal Entities

3 years ago

25

Picking the INCORRECT type of legal entity to do your crypto currency business could have a devastating impact on the taxes you pay in that activity. Similarly, if you do it the right way, it can have a huge benefit to you in your after-tax returns. Stay tuned and you will see how you can utilize correct business formation structure to maximize your after-tax crypto returns.

This is Kelly Coughlin, CPA and CEO of EverydayCPA. You saw in part 1 the three ways to generate profits and potentially taxes in the crypto currency market: 1) buy, hold and sell; 2) buy other goods and services or other currency; and 3) perform mathematical equations for a fee to build the blockchain.

http://www.taxresolutionhelpcenter.com

http://www.everydaycpa.com

Loading comments...

-

23:47

23:47

James Klüg

1 day agoAnti-Trumpers SNAP When I Arrive

9.63K25 -

LIVE

LIVE

FyrBorne

3 hours ago🔴Battlefield REDSEC Live M&K Gameplay: Turkey'ing Day

112 watching -

31:27

31:27

MetatronCore

1 day agoAsmongold Annihilated Kyle Kulinski

28.5K13 -

LIVE

LIVE

ytcBUBBLESBOOM

2 hours ago😥Can I just get this Battle Pass Done Now!! Live with Bubbles on Rumble 💚😋

74 watching -

LIVE

LIVE

Midnight In The Mountains™

1 hour agoMorning Coffee w/ Midnight & The Early Birds of Rumble | Happy ThanksGiving Stream | Long Live Rum!

152 watching -

1:02:57

1:02:57

ZeeeMedia

20 hours agoVaccines, Transhumanism & the Hidden Agenda ft. Dr. Suzanne Humphries | Daily Pulse Ep 152

19K47 -

15:42

15:42

Nikko Ortiz

17 hours agoPublic Freakouts Caught On Camera...

79.9K27 -

9:55

9:55

MattMorseTV

20 hours ago $19.09 earnedTheir ENTIRE PLOT just got EXPOSED.

26.1K91 -

1:55

1:55

Dr Disrespect

2 days agoPeak Focus. No Crash. This Is KENETIK

26.4K9 -

2:06:36

2:06:36

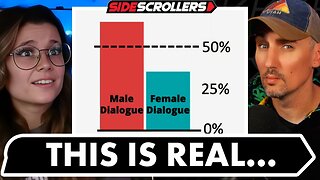

Side Scrollers Podcast

21 hours agoThis is the Dumbest Story We’ve Ever Covered… | Side Scrollers

79.7K22