Premium Only Content

ARE AMERICANS CASHING OUT?

Are Americans cashing out their home equity? ABSOLUTELY!!! Tappable Equity Rises $1 Trillion in Q2 2021 Alone to Hit All-Time High of $9.1 Trillion; Quarter Also Sees Largest Volume of Cash-Out Refis in 15 Years.

Driven by the red-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value (CLTV) ratio – surged nearly 40% from last year $9.1 trillion in total – yet another record high – the average mortgage holder now has $173,000 in tappable equity available to them, an increase of $20,000 from just the end of the first quarter.

Fewer than 3% of mortgage holders have less than 10% equity – the lowest share ever observed – with the overall weighted average CLTV now 46%, the lowest mortgage-to-value leverage on record

Some 98% of borrowers in active forbearance have at least 10% equity, as compared to the Great Recession when 40% of all mortgage holders had less than 10% equity with 28% fully underwater

Even when adding 18 months of deferred principal, interest, taxes, and insurance payments onto the total debt amount, only 7% of borrowers in forbearance would have less than 10% equity in their homes

More than $63 billion in equity was withdrawn via 1.1 million cash-out refinances originated in the second quarter, the largest quarterly volume since mid-2007

Driven by the epic-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value (CLTV) ratio – surged nearly 40% from last year

At $9.1 trillion in total – yet another record high – the average mortgage holder now has $173,000 in tappable equity available to them, an increase of $20,000 from just the end of the first quarter

Fewer than 3% of mortgage holders have less than 10% equity – the lowest share ever observed – with the overall weighted average CLTV now 46%, the lowest mortgage-to-value leverage on record

Some 98% of borrowers in active forbearance have at least 10% equity, as compared to the Great Recession when 40% of all mortgage holders had less than 10% equity with 28% fully underwater

Even when adding 18 months of deferred principal, interest, taxes, and insurance payments onto the total debt amount, only 7% of borrowers in forbearance would have less than 10% equity in their homes

More than $63 billion in equity was withdrawn via 1.1 million cash-out refinances originated in the second quarter, the largest quarterly volume since mid-2007

Be Creative and kind!

Connect on:

Instagram: https://www.instagram.com/themcclonebrothers/

Twitter: https://twitter.com/themcclonebrot1

LinkedIn: https://www.linkedin.com/in/themcclonebrothers/

BYIGTXWD1DILPZMW

-

51:56

51:56

NONCONFORMING-CONFORMIST

1 year ago $0.01 earnedMac Oligarchy #5

43 -

DVR

DVR

DLDAfterDark

4 hours agoGun Talk LIVE! Thursday At The Armory! Feat. Josh of BDG&G & DLD

1.74K1 -

2:50:16

2:50:16

TimcastIRL

5 hours agoSupreme Court May OVERTURN Gay Marriage, SCOTUS Hearing Set For TOMORROW | Timcast IRL

203K107 -

4:06:47

4:06:47

Barry Cunningham

6 hours agoBREAKING NEWS: PRESIDENT TRUMP HOSTS A STATE DINNER | FOX NATION PATRIOT AWARDS!

85.3K57 -

LIVE

LIVE

Alex Zedra

4 hours agoLIVE! New Game | The See Us

259 watching -

1:56:30

1:56:30

ThisIsDeLaCruz

3 hours ago $0.03 earnedOn The Road With Pantera

19.3K1 -

LIVE

LIVE

meleegames

3 hours agoMelee Madness Podcast #58 - They Changed What ‘It’ Was & It’ll Happen to You

78 watching -

2:32:46

2:32:46

megimu32

4 hours agoOn The Subject: Why K-Pop Demon Hunters Feels Like 90s Disney Again

15K9 -

1:38:28

1:38:28

Glenn Greenwald

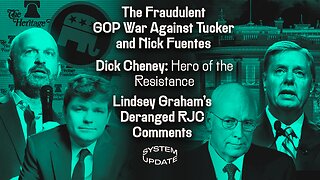

8 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

97.8K111 -

LIVE

LIVE

ThePope_Live

3 hours agoRedsack with the boys Cheap, Jah and Nova!

417 watching