Premium Only Content

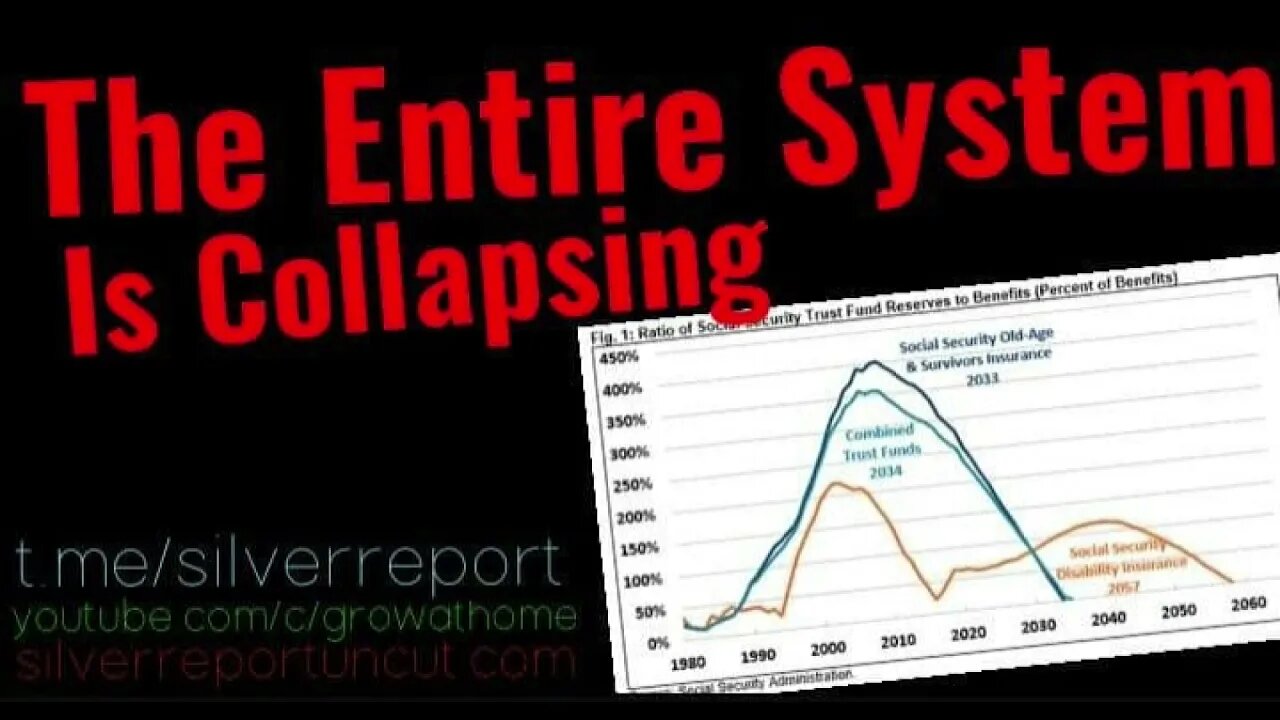

Don't Count On Gov Handouts For Retirement, We're A Few Short Years From A Social Security Crisis

Subscribe to grow at home http://youtube.com/c/growathome

and subscribe to our backup channel

http://bit.ly/backupchannellbry

http://silverreportuncut.com

Subscribe to the SRU podcast

http://soundcloud.com/silverreport

http://silverreportuncut.podbean.com

Follow Us On Telegram http://t.me/silverreport & https://parler.com/profile/silverreport/posts

anyone can post on our public group http://t.me/silverreportforum

Ad revenue is down almost 70%, it's viewers like you who help keep the sru coming! you can donate via crypto at our website or consider supporting our work on

http://buymeacoffee.com/silverreport

https://www.patreon.com/silverreport

Social Security provides the majority of income to most elderly Americans. The system provides at least 50 percent of incomes for about half of seniors. For roughly 1 in 4 seniors, it provides at least 90 percent of total incomes. But, that dependency ratio is directly tied to the financial insolvency of the vast majority of Americans. According to a CNBC report:

“Morning Consult found that nearly 18% of adults with an annual income of $50,000 or less have no savings, while some 34% have enough to cover just three months of expenses. Another 11% would deplete savings within six months. Only 10% of that income group has more than a year’s worth of cash.

Higher-income households are only somewhat better prepared, the survey found. Among those with annual incomes of $50,000 to $100,000, about 18% said they have between three months and six months of savings. About 25% said their cash would last less than three months, and 6% had set aside nothing at all. None of those questioned in that income group had more than a year’s worth of savings.”

There's just one problem, Social Security is Only 13 Years from Insolvency. Social Security cannot guarantee full benefits to current retirees under current law. The Trustees project the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033. The Social Security Disability Insurance (SSDI) trust fund will be insolvent by 2057. The theoretical combined trust funds will exhaust their reserves by 2034. Upon insolvency, all beneficiaries will face a 22% benefit cut.

-

2:51

2:51

SRU

3 years ago $0.06 earnedThe housing market crash of 2022 no one saw coming, Home Showings Crash 24% And Buyers Evaporate

1K -

1:42:41

1:42:41

Glenn Greenwald

7 hours agoReaction to Trump's Primetime Speech; Coldplay "Adultery" Couple Reappears for More Shame; Australia and the UK Obey Israel's Censorship Demands | SYSTEM UPDATE #560

106K67 -

2:46:41

2:46:41

Barry Cunningham

5 hours agoBREAKING NEWS: President Trump Signs The National Defense Authorization Act | More News!

29.4K20 -

43:10

43:10

Donald Trump Jr.

6 hours agoThe Days of Destructive DEI are Over, Plus Full News Coverage! | TRIGGERED Ep.301

99.3K67 -

52:07

52:07

BonginoReport

6 hours agoThe Internet Picks Bongino’s FBI Replacement - Nightly Scroll w/ Hayley Caronia (Ep.200)

95.7K63 -

55:30

55:30

Russell Brand

8 hours agoStay Free LIVE from AmFest — Turning Point USA - SF665

125K14 -

1:11:26

1:11:26

Kim Iversen

8 hours agoTrump Pulls War Fake-Out…Attack on Venezuela Still Coming!?

81.8K102 -

2:04:53

2:04:53

Redacted News

7 hours agoPutin just changed EVERYTHING with this move and NATO can't do anything | Redacted w Clayton Morris

173K139 -

25:22

25:22

DeVory Darkins

7 hours agoTrump scores MAJOR WIN after Inflation Report as his speech sparks EPIC MELTDOWN

56.8K59 -

1:01:23

1:01:23

Nick Freitas

8 hours agoLIVE at America Fest!

71.2K3