Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

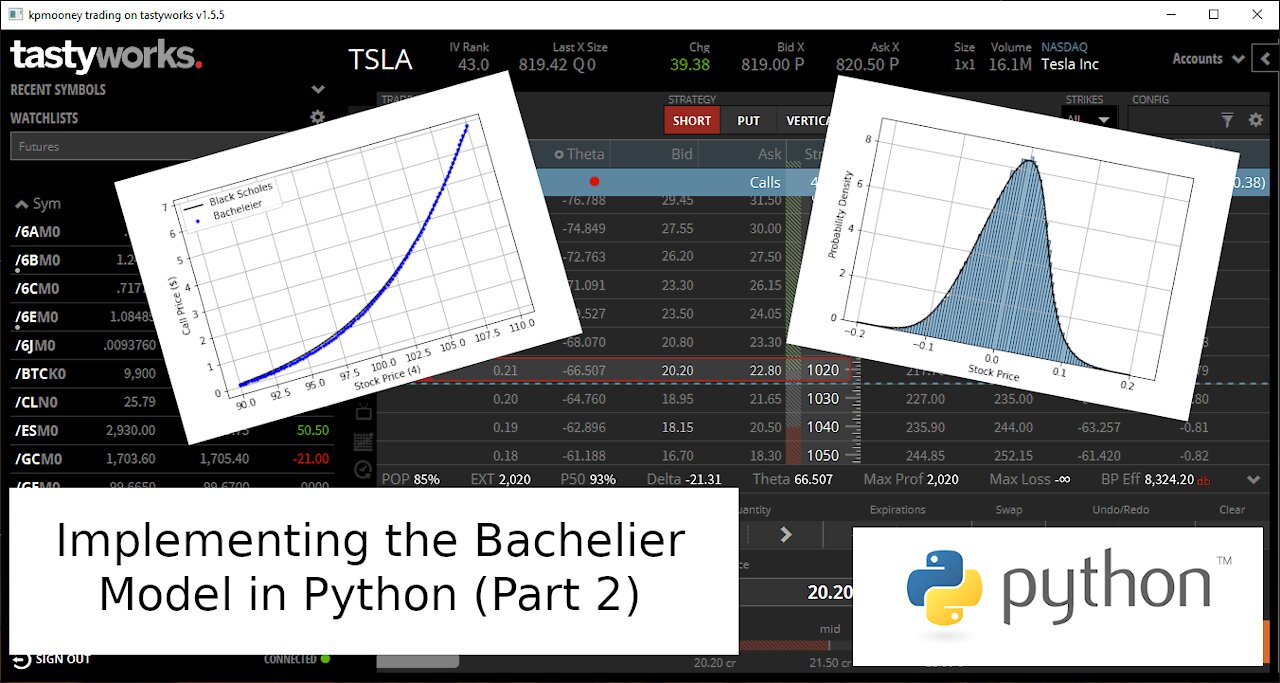

Implementing the Bachelier Option Pricing model in Python (Part 2)

4 years ago

29

In this video, we show how we can use put-call parity to build on our previous work and get the Bachelier put price. In the second part, we will play around with Sympy, Python’s symbolic algebra library. We will evaluate the call pricing model as we did numerically, but will use Sympy’s capabilities to get an analytical expression for Delta using the Bachelier model. We’ll compare that number to that we’d get using the Black-Scholes formula.

Part 1: https://youtu.be/L-YRF2A9MHE

Tipjar: https://paypal.me/kpmooney

Loading comments...

-

22:17

22:17

kpmooney

4 years agoImplementing the Bachelier Option Pricing model in Python (Part 1)

196 -

14:53

14:53

kpmooney

4 years agoGenerating Option Payoff Plots in Python

108 -

21:36

21:36

kpmooney

4 years agoCalculating Implied Volatility from an Option Price Using Python

134 -

11:24

11:24

kpmooney

4 years agoCalculating the Implied Volatility of a Put Option Using Python

10 -

8:16

8:16

kpmooney

4 years agoSolving Banded Linear Systems in Python (Part 4)

32 -

2:24

2:24

WSYM

5 years agoAffording Care, Membership Model Becoming A More Popular Option

7 -

17:46

17:46

kpmooney

4 years ago $0.01 earnedNumerically Solve Boundary Value Problems: The Shooting Method with Python (Part 1)

115 -

2:22

2:22

WTMJMilwaukee

5 years agoOconomowoc school district transitions to face-to-face learning model with virtual option

9 -

14:02

14:02

pcomitz

4 years agopython functions

106 -

14:36

14:36

kpmooney

4 years agoDifferential Equations and Maximizing Functions in Python: Solving Simple Physics Problems (Part 2)

27