Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Calculating Implied Volatility from an Option's Price Using the Binomial Model

4 years ago

67

I wanted to do a quick video following up with the binomial option model we looked at in an earlier video. I’ll quickly show how we can use Scipy’s function fsolve to solve for the IV. This is a simple extension on concepts we’ve already discussed using Black-Scholes as the p[ricing model.

Binomial Model: https://youtu.be/d7wa16RNRCI

Tip Jar: https://paypal.me/kpmooney

Loading comments...

-

21:36

21:36

kpmooney

4 years agoCalculating Implied Volatility from an Option Price Using Python

134 -

11:24

11:24

kpmooney

4 years agoCalculating the Implied Volatility of a Put Option Using Python

10 -

13:26

13:26

kpmooney

4 years agoCalculating the Implied Volatility of an Option with Excel (or Google Sheets)

114 -

21:57

21:57

kpmooney

4 years agoUsing Scipy to Find the Prices of a Stock and its Volatility from a Call Spread Price

31 -

13:14

13:14

kpmooney

4 years agoDebugging the Python Implied Volatility Code

28 -

20:08

20:08

kpmooney

4 years agoImplementing the Binomial Option Pricing model in Python

53 -

13:53

13:53

kpmooney

4 years agoCalculating the Correlations Between Stocks Using Python

60 -

26:10

26:10

kpmooney

4 years agoCalculating Option Greeks Using a Spreadsheet (or Python)

26 -

2:02

2:02

The PyTorch Channel

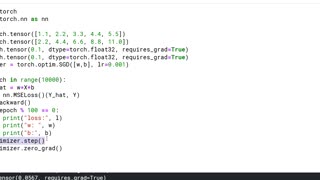

4 years agoTutorial 2: Train a linear regression model using the SGD optimizer

35 -

17:23

17:23

The PyTorch Channel

4 years agoTutorial 8: Handwritten digit image classification using a logistic regression model

78