Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

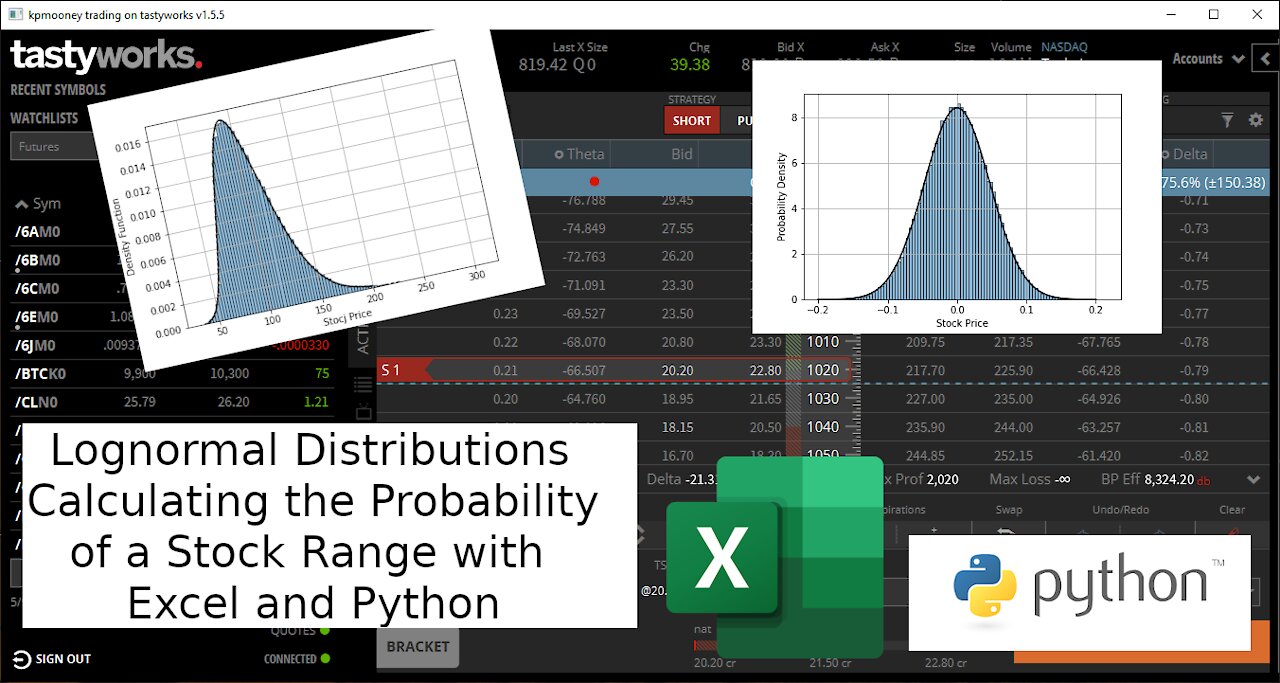

Lognormal Distributions: Calculating the Probability of a Stock Range with Excel and Python

4 years ago

42

In response to a viewer question, we look at how to calculate the probability a stock will be in a given price range at a certain time given its implied volatility. We will compare this against our Monte Carlo simulations worked out last year. We will do the calculation both in Excel and Python.

Tip Jar: https://paypal.me/kpmooney

Github: https://github.com/kpmooney/numerical_methods_youtube/tree/master/lognormal

Stock Monte Carlo and Linear Systems: https://youtu.be/AC_4gjSYzu0

Loading comments...

-

15:12

15:12

kpmooney

4 years agoCalculating Simple Statistics with Python and Pandas: Stock Market Data

52 -

12:34

12:34

kpmooney

4 years ago $0.01 earnedCalculating Probability of Making 50% of Max Profit on a Short Strangle Using Python

45 -

13:53

13:53

kpmooney

4 years agoCalculating the Correlations Between Stocks Using Python

60 -

18:24

18:24

kpmooney

4 years agoProbability of a Touch in Finance using Python Monte Carlo Methods

41 -

14:06

14:06

pcomitz

4 years agoGetting Started with Python

194 -

13:26

13:26

kpmooney

4 years agoCalculating the Implied Volatility of an Option with Excel (or Google Sheets)

114 -

5:38

5:38

Subjectmoney.com

4 years ago $0.01 earnedExcel COUNTIF Function Tutorial: Excel 2016 Range Criteria Greater Than

76 -

21:36

21:36

kpmooney

4 years agoCalculating Implied Volatility from an Option Price Using Python

134 -

11:24

11:24

kpmooney

4 years agoCalculating the Implied Volatility of a Put Option Using Python

10 -

16:19

16:19

kpmooney

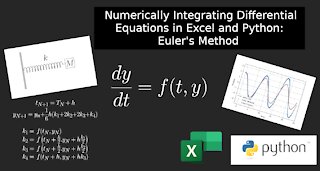

4 years agoNumerically Integrating Differential Equations in Excel and Python: Euler's Method

29